If You Had Bought Hostess Brands (NASDAQ:TWNK) Stock Three Years Ago, You Could Pocket A 25% Gain Today

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. That’s what has happened with the Hostess Brands, Inc. (NASDAQ:TWNK) share price. It’s up 25% over three years, but that is below the market return. Unfortunately, the share price has fallen 16% over twelve months.

View our latest analysis for Hostess Brands

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

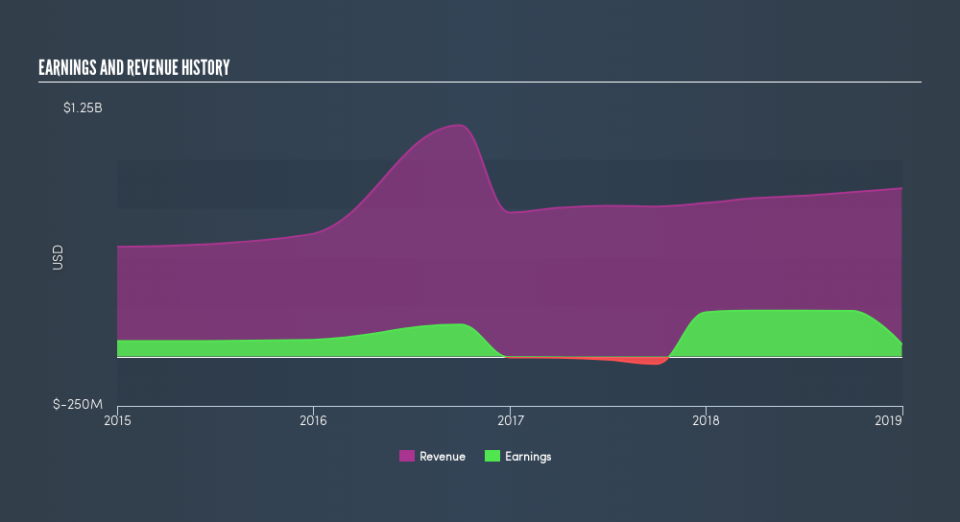

Over the last three years, Hostess Brands failed to grow earnings per share, which fell 56% (annualized). Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it’s worth considering other metrics as well.

We severely doubt anyone is particularly impressed with the modest 2.0% three-year revenue growth rate. While we don’t have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Hostess Brands shareholders are down 16% for the year, but the broader market is up 6.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 7.6% per year over three years. Sometimes when a good quality long term winner has a weak period, it’s turns out to be an opportunity, but you really need to be sure that the quality is there. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Hostess Brands by clicking this link.

Hostess Brands is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.