If You Had Bought Motor Oil (Hellas) Corinth Refineries (ATH:MOH) Shares Five Years Ago You'd Have Made 167%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. Long term Motor Oil (Hellas) Corinth Refineries S.A. (ATH:MOH) shareholders would be well aware of this, since the stock is up 167% in five years.

View our latest analysis for Motor Oil (Hellas) Corinth Refineries

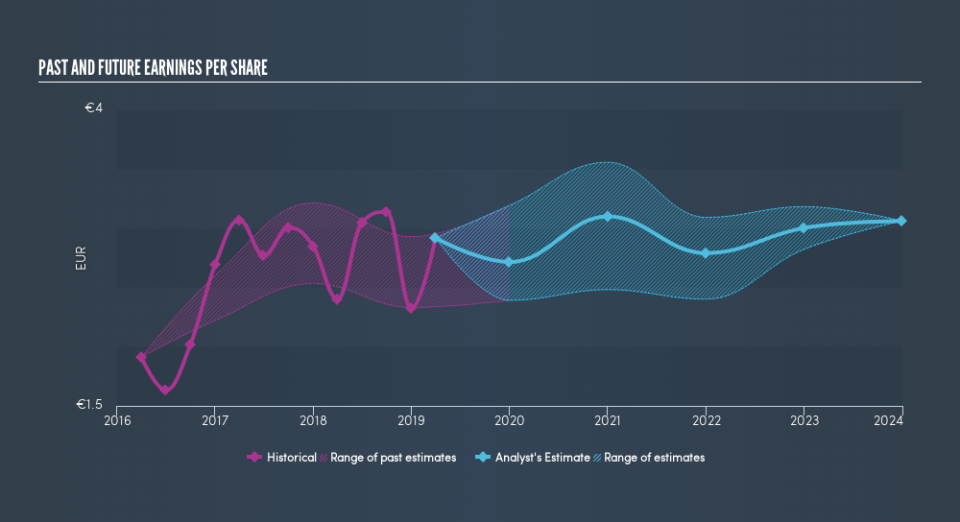

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Motor Oil (Hellas) Corinth Refineries moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the Motor Oil (Hellas) Corinth Refineries share price has gained 112% in three years. In the same period, EPS is up 15% per year. This EPS growth is lower than the 28% average annual increase in the share price over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Motor Oil (Hellas) Corinth Refineries has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Motor Oil (Hellas) Corinth Refineries the TSR over the last 5 years was 243%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Motor Oil (Hellas) Corinth Refineries's TSR for the year was broadly in line with the market average, at 11%. It has to be noted that the recent return falls short of the 28% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. Importantly, we haven't analysed Motor Oil (Hellas) Corinth Refineries's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.