If You Had Bought Nutanix (NASDAQ:NTNX) Stock A Year Ago, You'd Be Sitting On A 27% Loss, Today

It is a pleasure to report that the Nutanix, Inc. (NASDAQ:NTNX) is up 38% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 27% in one year, under-performing the market.

See our latest analysis for Nutanix

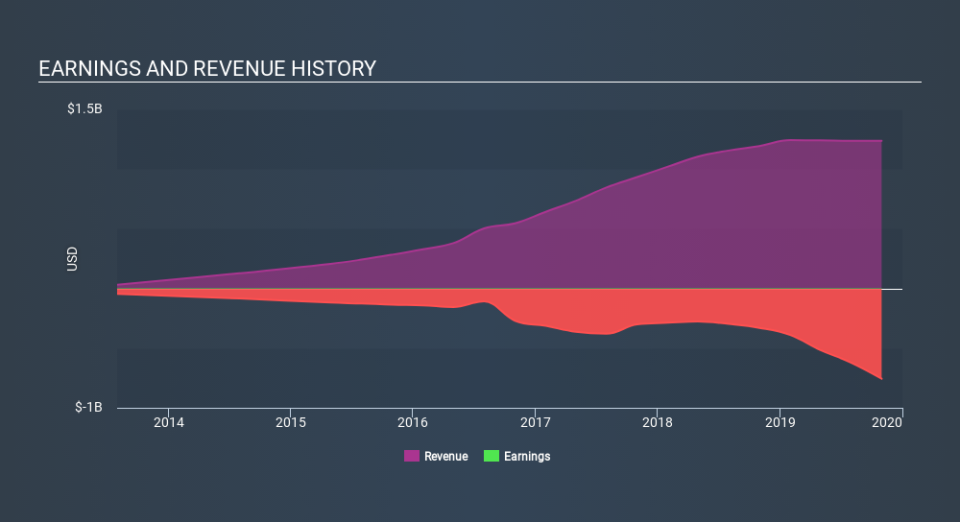

Nutanix wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Nutanix saw its revenue grow by 3.7%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 27% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Nutanix is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

The last twelve months weren't great for Nutanix shares, which cost holders 27%, while the market was up about 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 4.3% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.