If You Had Bought Office Properties Income Trust (NASDAQ:OPI) Stock Five Years Ago, You'd Be Sitting On A 65% Loss, Today

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. So we wouldn't blame long term Office Properties Income Trust (NASDAQ:OPI) shareholders for doubting their decision to hold, with the stock down 65% over a half decade.

View our latest analysis for Office Properties Income Trust

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Office Properties Income Trust has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower.

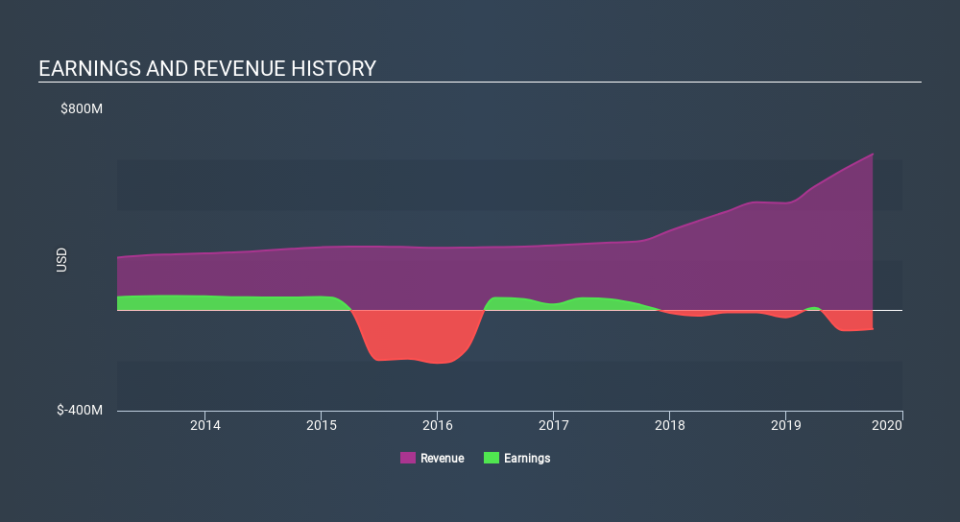

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Office Properties Income Trust in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Office Properties Income Trust's TSR for the last 5 years was -43%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Office Properties Income Trust shareholders gained a total return of 4.7% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 11% per year, over five years. It could well be that the business is stabilizing. Before forming an opinion on Office Properties Income Trust you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course Office Properties Income Trust may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.