If You Had Bought Reliance Worldwide (ASX:RWC) Shares A Year Ago You'd Have Earned 96% Returns

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. For example, the Reliance Worldwide Corporation Limited (ASX:RWC) share price is up 96% in the last year, clearly besting the market return of around 49% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Having said that, the longer term returns aren't so impressive, with stock gaining just 3.2% in three years.

View our latest analysis for Reliance Worldwide

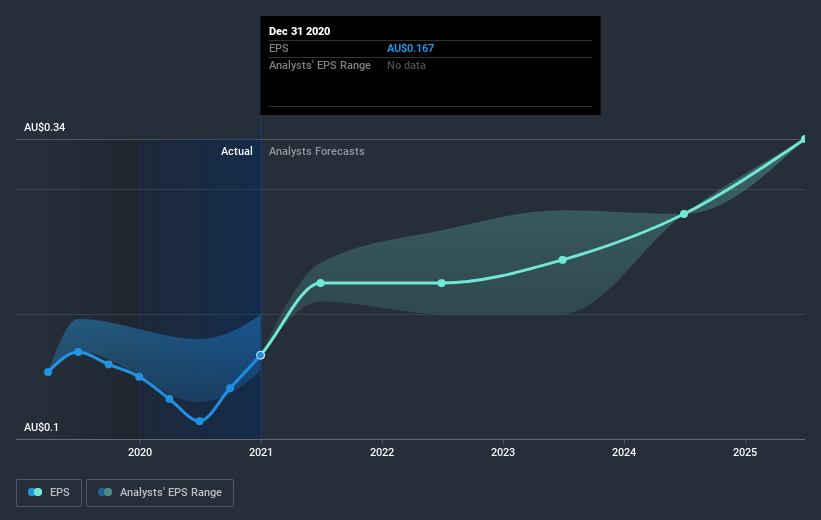

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Reliance Worldwide grew its earnings per share (EPS) by 12%. This EPS growth is significantly lower than the 96% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Reliance Worldwide has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Reliance Worldwide the TSR over the last year was 100%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Reliance Worldwide rewarded shareholders with a total shareholder return of 100% over the last year. That's including the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 4%. The improving returns to shareholders suggests the stock is becoming more popular with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Reliance Worldwide may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.