If You Had Bought SunLink Health Systems (NYSEMKT:SSY) Stock Five Years Ago, You'd Be Sitting On A 32% Loss, Today

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term SunLink Health Systems, Inc. (NYSEMKT:SSY) shareholders for doubting their decision to hold, with the stock down 32% over a half decade. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

View our latest analysis for SunLink Health Systems

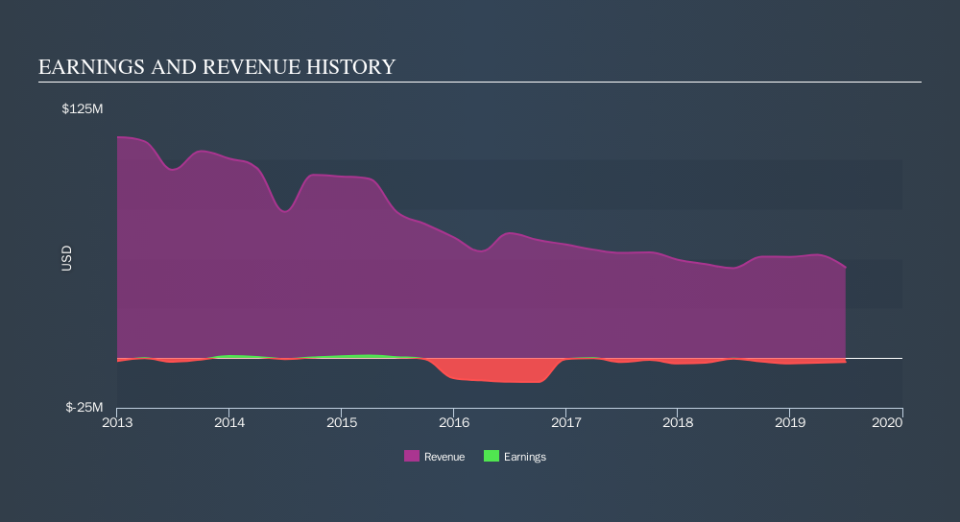

Given that SunLink Health Systems didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years SunLink Health Systems saw its revenue shrink by 13% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 7.3% compound, over five years is well justified by the fundamental deterioration. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in SunLink Health Systems had a tough year, with a total loss of 4.2%, against a market gain of about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 7.3% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. If you would like to research SunLink Health Systems in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.