If You Had Bought Thruvision Group (LON:THRU) Stock Three Years Ago, You Could Pocket A 71% Gain Today

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, the Thruvision Group plc (LON:THRU) share price is up 71% in the last three years, clearly besting the market decline of around 0.6% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 29%.

See our latest analysis for Thruvision Group

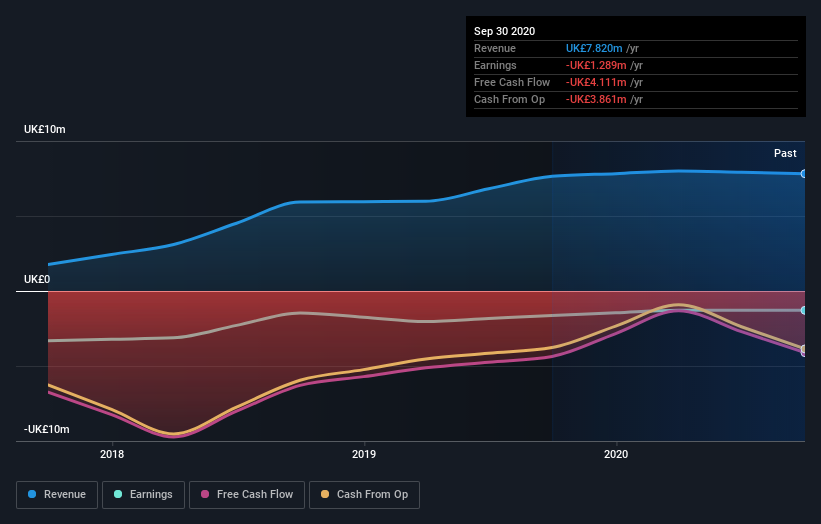

Thruvision Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Thruvision Group's revenue trended up 37% each year over three years. That's well above most pre-profit companies. The share price rise of 20% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at Thruvision Group. If the company is trending towards profitability then it could be very interesting.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Thruvision Group shareholders have received a total shareholder return of 29% over the last year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Thruvision Group has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.