If You Had Bought VersaPay (CVE:VPY) Shares Five Years Ago You'd Have Made 66%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the VersaPay Corporation (CVE:VPY) share price is up 66% in the last 5 years, clearly besting than the market return of around 0.6% (ignoring dividends).

View our latest analysis for VersaPay

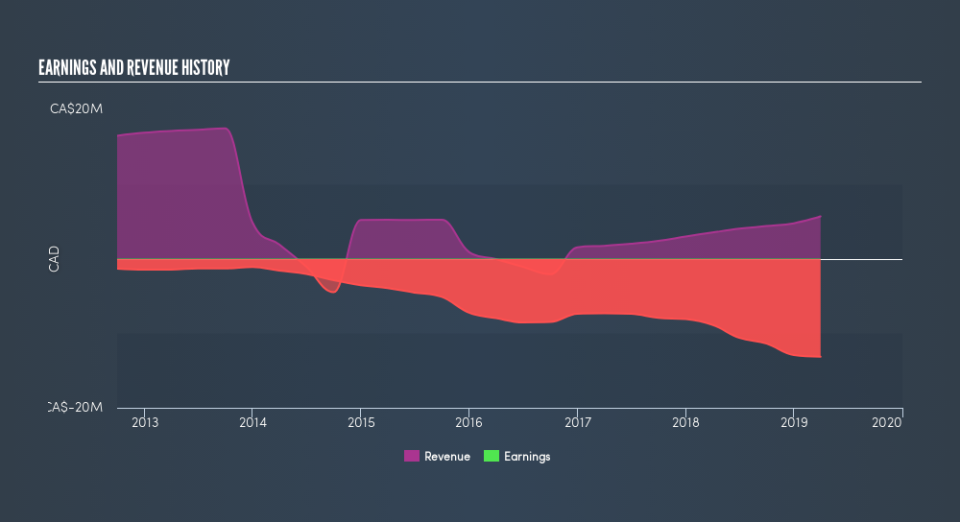

Because VersaPay is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, VersaPay can boast revenue growth at a rate of 22% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 11%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at VersaPay. Opportunity lies where the market hasn't fully priced growth in the underlying business.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

VersaPay shareholders are down 25% for the year, but the market itself is up 0.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.