If You Had Bought WANdisco (LON:WAND) Shares Three Years Ago You'd Have Made 34%

One simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. For example, the WANdisco plc (LON:WAND) share price is up 34% in the last three years, clearly besting the market return of around 8.1% (not including dividends).

Check out our latest analysis for WANdisco

WANdisco wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

WANdisco's revenue trended up 14% each year over three years. That's a very respectable growth rate. While the share price has done well, compounding at 10% yearly, over three years, that move doesn't seem over the top. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

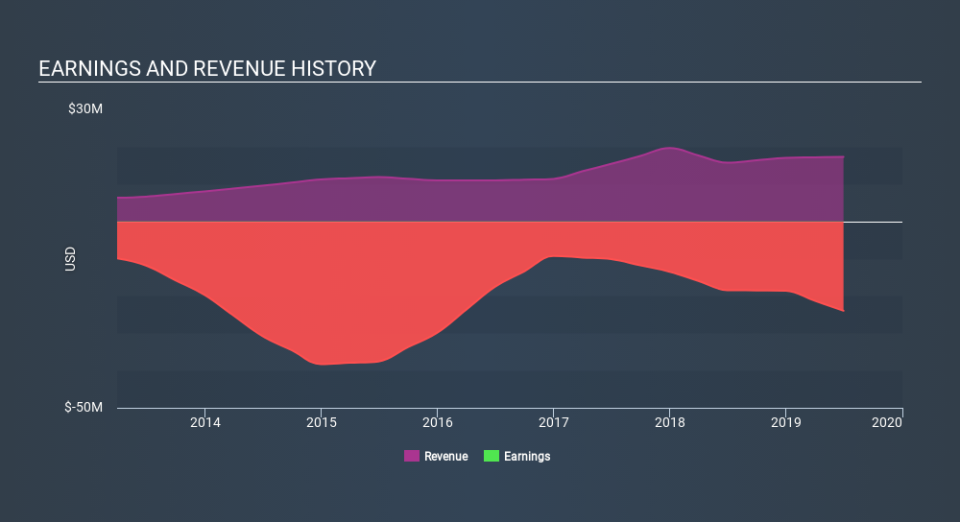

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 18% in the last year, WANdisco shareholders lost 8.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 2.8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with WANdisco , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.