Hafnium: Small Supply, Big Applications

The market for hafnium, a metal crucial to both the aerospace and nuclear energy industries, may remain a relatively tiny one for now. But look for it to grow much bigger in the global infrastructure build-out to come.

With an average crustal abundance of 3 ppm (parts per million), hafnium—a shiny, silver-gray metal often used in alloys and nuclear science—certainly isn't rare. The metal is more abundant in the Earth's crust than gold, silver, the PGMs, a number of the rare earths and the likes of germanium, tantalum and molybdenum. But as a metal, hafnium is only produced in quite small quantities, currently probably not much more than 70 tonnes a year.

There are two main reasons for this. First, hafnium is only ever produced as a byproduct of refining zirconium for use in nuclear-related applications, especially in nuclear power plants. Second, it is extremely difficult to separate the metal from zirconium, the element with which it is most often found.

Indeed, because of this, only two significant producers of the metal exist worldwide at present: ATI Wah Chang (part of Allegheny Technologies Inc. (NYSE: ATI) in Oregon in the U.S.; and CEZUS in Jarrie, France (part of France's AREVA group (PA: CEI) and the world's largest builder of nuclear power stations).

A Bit Of History

Given the difficulties in recovering the metal, it may come as no surprise that hafnium was one of the last elements to be discovered. Although scientists had already reserved a place for it on the periodic table, element 72 (hafnium) had yet to be identified as recently as 1920.

In 1923, hafnium was identified (using X-ray analysis) as being distinct from zirconium, and recognized as an element in its own right by the Dutch physicist Dirk Coster and Nobel Prize-winning Hungarian chemist György Hevesy, working in Copenhagen, Denmark. The name hafnium comes from Hafnia, the Latin name for Copenhagen.

Whence Hafnium?

In its metallic state, hafnium is a shiny, ductile metal about twice as dense as zirconium. However, hafnium is never found as a pure metal, and it must undergo a long and complex refining process to end up as such.

In nature, hafnium occurs with zirconium at a ratio of around 1:50, appearing in a number of zirconium-bearing ores and minerals, such as zircon and baddeleyite. (There are at least two other hafnium-bearing ores—alvite and hafnon—but they are not common.)

The primary source of hafnium is the zircon that results from the processing of zirconium-bearing ilmenite, or heavy mineral sands. This is further separated into rutile (consisting mainly of titanium dioxide, TiO2) and zircon (ZrSiO4) sand. (Not all ilmenites, however, contain zirconium and, thus, hafnium.)

The world's major producers of zircon sand are Australia, South Africa and China, while Brazil, Ukraine and Russia all possess and produce commercially viable resources of baddeleyite:

Source: U.S. Geological Survey

Note: Does not include U.S. production

The production of hafnium metal is predicated upon the production of zirconium metal sponge from zircon sand, generally for the nuclear industry. For zirconium to be effective in nuclear fuel rods, it needs to be as transparent and impermeable to neutrons as possible. This, in turn, requires that the rods contain as little hafnium as possible, since hafnium's thermal neutron absorption cross section is some 600 times that of zirconium.

While their neutron absorption properties of hafnium and zirconium are almost exactly opposite, in nearly all other aspects except density, the two metals' chemistries are nearly identical. This is why they are so difficult to separate.

In the past, hafnium metal was produced via a process developed by van Arkel and de Boer, in which the vapor of the tetraiodide was passed over a heated tungsten filament. These days, nearly all hafnium metal is made via the Kroll process, by reducing the tetrachloride either with magnesium or with sodium. The metal can then be purified further either using the van Arkel/de Boer iodine process or electron beam melting. The first method is currently used by ATI Wah Chang to produce its ultralow zirconium hafnium crystal bar.

Van Arkel – Crystal Bar Pieces

Source: Lipmann Walton

Uses Of Hafnium

Currently, hafnium has three important uses: superalloys (in both aerospace and nonaerospace), refractory metal alloys and nuclear applications.

Alloys

In high-temperature alloys and polycrystalline nickel-based superalloys, hafnium's high melting point—2,233°C (4,051°F)—helps strengthen grain boundaries, thus considerably improving both high-temperature creep and tensile strength. In addition, with its high affinity for carbon, nitrogen and oxygen, the metal also provides strengthening through second-phase particle dispersion.

One of the most common uses of hafnium is as one of the alloys in the superalloys used in the turbine blades and vanes found in the "hot end" of jet engines, i.e., in environments with very high temperatures and pressure and high stress. Such superalloys can contain 1-2 percent hafnium. For example, MAR-M 247—a polycrystalline nickel-based alloy developed by Martin-Marietta Corp. and used by Siemens in land-based turbines that operated at temperatures up to 1,038˚C—contains 1.5 percent hafnium.

Hafnium can also to be found in a number of other alloys, such as tantalum-based T111 (Ta-8%W-2%Hf); tantalum/tungsten-based T222 (Ta-10%W-2.5%Hf-0.01%C) and molybdenum-based MHC, or molybdenum-hafnium-carbide, which breaks into 1.2%Hf-0.1%C (the rest moly). In addition, it can be found in a number of niobium-based alloys: C-103 (10% Hf-1%Ti-1%Zr); C-129Y (10%W-10%Hf-0.7%Y) and WC-3015 (30%Hf-15%W-1.5%Zr).

Among other applications, niobium-based alloys containing hafnium have been used as coatings for cutting tools, while C-103 and hafnium-tantalum-carbide have been used in the fabrication of rocket engine thruster nozzles.

In both alloys containing tantalum and molybdenum, as well as in binary compounds, hafnium is also an excellent refractory material. With a melting point of over 3,890°C, hafnium carbide (HfC) makes one of the most refractory binary materials around. And with a melting point of some 3,310°C, hafnium nitride is the most refractory of all known metal nitrides.

And there could be a number of as-yet-undiscovered uses for hafnium both in alloys and in catalysts. Several years ago, an article appeared in Chemical & Engineering News: "Happening Hafnium: Once obscure transition metal is now garnering attention as a potential superstar catalyst."

Nuclear

We have hafnium metal only as a result of the decision to use zirconium in nuclear applications. As mentioned previously, purified zirconium must contain as little hafnium as possible to be of any use in uranium-based fuel rods, so the hafnium must be entirely removed. Thus, it's perhaps appropriate that, apart from its use in alloys, one of hafnium's other major applications is in nuclear contexts.

While the chemistry of hafnium and zirconium may be quite similar, their properties in a nuclear environment could not be more dissimilar. Zirconium is virtually transparent to neutrons, while hafnium is extremely absorbent. Thus, while the fuel rods themselves are often made out of zirconium, control rods (which mop up the neutrons flying around and, therefore, slow nuclear fission in the reactor) are often made of hafnium. One of their first uses in this context was in the pressurized light water reactors used to power such naval vessels as submarines.

It is, though, interesting to note that the effects of contamination of one metal by the other appear not to be symmetric; hafnium control rods can still function effectively if they contain up to 4.5 percent zirconium, but certainly not vice versa for fuel rods. In addition to its neutron absorbency, hafnium also boasts two further valuable properties in the nuclear context: strength and resistance to corrosion.

Other applications of hafnium are quite varied:

Plasma welding and arc cutting: Because of its ability to shed electrons into air and hence establish an electric arc, hafnium is used as an insert in plasma torch welding tips instead of tungsten, and as a cathode in plasma arc cutting.

Microprocessors: Chip-makers use hafnium chloride (HfCl4) and hafnium oxide (HfO2) in microprocessors, not least of which because its temperature resistance makes it a good replacement for silicon. For example, Intel's 45nm high-k chip is hafnium-based, following the company's discovery that "introducing hafnium into silicon chips helps reduce electrical leakage enabling smaller, more energy-efficient and performance-packed processors." Other electronics companies are now looking at the possibility of using hafnium oxide to make ReRAM.

CVD/PVD coating: Hafnium is often used as a thin film coating to provide hardness and protection (for example, in optical applications), via either chemical vapor deposition (CVD) or physical vapor deposition (PVD).

Lasers: Hafnium oxide is also used in blue lasers in DVD readers.

Demand For Hafnium

Figures for both demand and supply of hafnium are extremely difficult to find, not least because of both the exiguous number of producers and the relatively small number of consumers. It is, therefore, possible only really to give either "typical" figures or best "estimates."

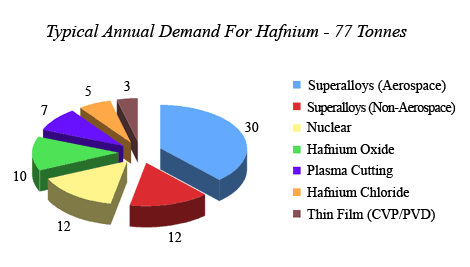

On the demand side, typical annual demand for the metal remains around 77 tonnes.

Sources: Lipmann Walton & Co Ltd and Avon Metals Ltd

While the demand for hafnium from the electronics industry (for chips) appears to be increasing slightly, there is strong demand growth for the metal both in air plasma applications and superalloys. (In the aerospace industry, in general, engine manufacturers are always seeking materials that will enable their engines to run at higher temperatures and, hence, consume fuel more efficiently.)

It is, however, from the nuclear industry that the greatest growth in demand may arise. According to the World Nuclear Association, quoting figures from the Nuclear Engineering International Handbook 2010, there are currently some 439 nuclear power plants in commercial operation alone, with 60 under construction in 15 different countries. More than 155 further power reactors are planned worldwide, with over 320 more proposed. What's more, in order to increase capacity, many reactors already in operation are either in the process of or will soon be upgraded. And this does not take into account the routine maintenance/replacement work that is always being undertaken.

That said, however, control rods in, say, pressurized water reactors are not exclusively made using hafnium. Because of both its limited availability and relatively high price, a number of other materials can be and are substituted; for example, boron or silver-indium-cadmium alloys, which usually contain 80 percent Ag, 15 percent In, and 5 percent Cd.

Supply Of Hafnium

Estimates are that the two main hafnium producers, ATI Wah Chang and CEZUS, produce around 40 tonnes and 30 tonnes of the metal annually, respectively (of which, 20 tonnes and 10 tonnes, respectively, is hafnium crystal bar, which has both ultralow gas and zirconium contents). It may be less, however.

India produces the metal but does not export it. China, too, produces hafnium, but not of any useful purity: maybe around two tonnes a year. While both the technology and plants currently exist to remove hafnium from zirconium, they do not yet exist to refine hafnium to any significant level of purity; for example, 0.2-0.5 percent (or ultra/extra low) zirconium content.

In the past, both Russia and Ukraine produced hafnium under the Soviet system. In Russia, JSC "Chepetsky Mechanical Plant," Glasov still lists hafnium as one of its products. And in Ukraine, the Volnogorsk State Mining-Metallurgical Integrated Works in the Dnepropetrovsk region indicates that it, too, produces hafnium. Estimates are that only some 2 tonnes of hafnium currently come out of Russia and/or Ukraine currently; most of what originates from Ukraine most probably comes from stockpiled past production rather than any current production.

Looking ahead, Russia certainly has the potential to produce anywhere between 3 and 10 tonnes of hafnium a year, and Ukraine perhaps even 5 tonnes. And, with its nuclear energy ambitions, China will certainly be looking at producing high-purity hafnium sooner rather than later. Whether it will export any excess (should there be any), however, remains imponderable.

What is being produced "under the radar," however, is anybody's guess.

Hafnium Prices

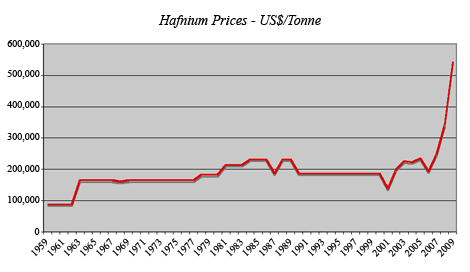

The price of hafnium is interesting on two counts. First, historically, the price of the metal has remained very steady over quite long periods—from 1970 to 2000 there was extraordinarily little volatility in it price. Second, it appears to be so cheap!

Source: U.S. Geological Survey

Currently, hafnium with 0.2-0.5 percent zirconium content sells for around $1,200-1,300 per kilogram. On occasion, hafnium with an even lower zirconium content (<0.1 percent) is produced and sold at an even higher premium. The metal with 0.5-1.0 percent zirconium content sells for $800-900 per kilo, while that with 1-3 percent zirconium content sells for $500-700 per kilo.

However, with only around 70 tonnes of the metal being produced each year, compared to, say, only about 50 tonnes of rhenium produced each year, one wonders: Why does hafnium fetch so much less than rhenium, which currently sells for $4,000-5,000 per kilo?

Opportunities In Hafnium

Unfortunately, because of both its strategic nature in the nuclear arena and the difficulties involved in its production, there are no pure plays in hafnium. Hafnium is either produced by state-owned concerns or as just one line of business for the two big groups producing the metal commercially: ATI Wah Chang and CEZUS.

Of course, "pure play" in this context will never be possible insofar as hafnium production having always been associated with zirconium production. However, this is not to say that, looking ahead, there may not be companies in either China or Russia that offer pure plays in both. Whether or not they are permitted to be publicly owned, though, is a different matter.

And for any of you who may be wondering if you can go out, buy a bar of hafnium crystal and store it in your cellar as an investment, the answer is pretty much an assured: "No!"

While the metal itself is, in most (but not all) forms, not hazardous, under the "Nuclear Non-Proliferation Treaty," hafnium is considered a "dual use" metal. So, any chances of your buying it, as an investor, without the correct import/export licenses and end-user statements and squirreling it away are probably zippo.

But don't think people haven't tried smuggling it: Ukrainian Customs Confiscate Nuclear Material from Two Germans and Bulgaria Prevents Smuggling of Nuclear Metal. In this last instance, four men tried to get 3.4 kg of the metal across the border from Bulgaria to Romania undetected. Of course, the question remains as to why they were stopped in the first place ...

Afterword

For those who might enjoy reading about some of the more "interesting" possible uses of hafnium, discussions around its use as an energy source or weapon of mass destruction are sure to amuse - if only for some of the surprising claims that have, in the past, been made of the metal.

Resources

U.S. Geological Survey (USGS)

If you liked this article, then check out:

What WikiLeaks Revealed About ‘Key Metals'

Kris Van den Broeck: The Benefits Of Metals Recycling

The Commodity Roundtable: 2011 The Year Of Copper, Dragon Metals

Recommended Stories