Halliburton (HAL) Q3 Earnings Top Despite North America Woes

Oilfield services behemoth Halliburton Company HAL reported slightly higher-than-expected third-quarter profit after robust international activity more than offset slowdown in the North American drilling fluids demand and pricing pressure in the United States land drilling business.

The world's second-largest oilfield services company after Schlumberger SLB saw its income from continuing operations come in at 50 cents per share, just ahead of the Zacks Consensus Estimate of 49 cents and well above the year-ago profit of 42 cents. Meanwhile, revenues of $6,172 million beat the Zacks Consensus Estimate of $6,131 million and increased 13.4% year over year.

Importantly, Halliburton joined fellow oil services biggie Schlumberger in affirming rebounding activity in the international markets. As proof of resurgence, Halliburton saw its sales from outside North America go up 5% sequentially, with growth in each region.

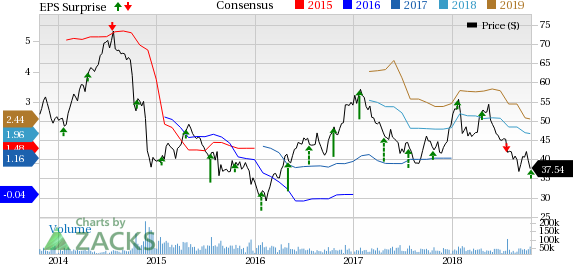

Halliburton Company Price, Consensus and EPS Surprise

Halliburton Company Price, Consensus and EPS Surprise | Halliburton Company Quote

Segmental Performance

Operating income from the Completion and Production segment was $613 million, 16.3% above the year-ago level of $527 million. The division’s performance was helped by higher completion tool sales and well intervention services in the Eastern Hemisphere, coupled with improved stimulation activity in Mexico.

However, the segment operating income could not match our consensus estimate of $641 million. The shortfall could be attributed to pricing pressure and higher maintenance costs in the North American land drilling business.

Meanwhile, Drilling and Evaluationunit profit fell from $186 million in the third quarter of 2017 to $181 million this year. The segment income was also below the Zacks Consensus Estimate of $219 million. The underperformance was on account of lower drilling fluids activity in North America.

Balance Sheet

Halliburton’s capital expenditure in the third quarter was $409 million. As of Sep 30, 2018, the company had approximately $2,057 million in cash/cash equivalents and $10,424 million in long-term debt, representing a debt-to-capitalization ratio of 53.6%.

Zacks Rank & Stock Picks

Halliburton currently carries a Zacks Rank #5 (Strong Sell), implying that it is expected to perform below the broader U.S. equity market over the next one to three months.

Meanwhile, one can look at better-ranked oilfield service players like Helix Energy Solutions Group, Inc. HLX and Unit Corporation UNT. Both the companies carry a Zacks Rank #1 (Strong Buy).

(You can see the complete list of today’s Zacks #1 Rank stocks here.)

The 2018 Zacks Consensus Estimate for Helix Energy is 20 cents, representing some 233.3% earnings per share growth over 2017. Next year’s average forecast is 29 cents, pointing to another 47.9% growth.

The 2018 Zacks Consensus Estimate for Unit Corporation is 86 cents, representing some 59.3% earnings per share growth over 2017. Next year’s average forecast is $1.12, pointing to another 29.7% growth.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

Unit Corporation (UNT) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research