Hanesbrands (HBI) to Report Q3 Earnings: Things to Keep in Mind

Hanesbrands Inc. HBI is likely to witness growth in the bottom line when it reports third-quarter 2021 numbers on Nov 4. The Zacks Consensus Estimate for quarterly earnings, which has remained unchanged in the past 30 days at 47 cents per share, suggests an increase of 11.9% from the year-ago quarter’s reported figure. The designer, manufacturer and seller of apparel has a trailing four-quarter earnings surprise of 29.6%, on average. Hanesbrands delivered an earnings surprise of 20.5% in the last reported quarter.

We note that, the Zacks Consensus Estimate for quarterly revenues is pegged at $1,798 million.

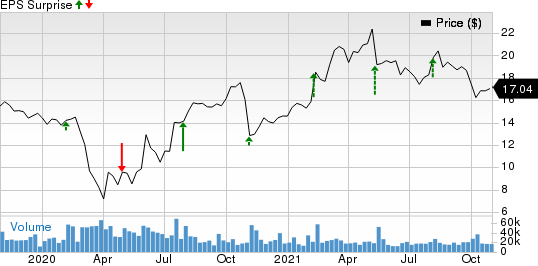

Hanesbrands Inc. Price and EPS Surprise

Hanesbrands Inc. price-eps-surprise | Hanesbrands Inc. Quote

Things To Note

Hanesbrands is focused on making incremental investments in its online business to keep pace with consumers’ evolving shopping patterns. Strength in the company’s Full Potential plan, designed around four pillars, namely, grow global Champion, re-ignite innerwear growth, drive consumer-centricity and focus the portfolio bodes well. In addition, the company has been benefiting from solid demand across its innerwear and activewear businesses.

For the third quarter, net sales from continuing operations are anticipated in the range of $1.78-$1.81 billion. The midpoint of the guidance suggests an increase of nearly 6% year over year and includes an expected gain of nearly $16 million from favorable currency movements. Excluding personal protective equipment, net sales at the midpoint are likely to have jumped 19%. Also, adjusted earnings per share are envisioned in the band of 45-48 cents for the to-be-reported quarter. The company had reported adjusted earnings of 42 cents in the same period last year.

Yet, on its last earnings call, management highlighted that the pandemic continues to impact the macroeconomic landscape. Additionally, global supply-chain bottlenecks and rising cost pressure remain concerns. Hanesbrands had earlier guided third-quarter adjusted operating profit in the range of $235-$245 million. At the midpoint, this indicates an operating margin of 13.4%, down from 14.3% posted in the year-ago quarter. Cost inflation and higher brand investment are likely to have affected operating margin in the quarter to be reported.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Hanesbrands this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hanesbrands currently carries a Zacks Rank #2 and has an Earnings ESP of +1.06%.

More Stocks With Favorable Combinations

Here are some other companies that you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat.

PVH Corp. PVH currently has an Earnings ESP of +4.84% and a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gildan Activewear Inc. GIL currently has an Earnings ESP of +7.14% and a Zacks Rank of 3.

Ralph Lauren Corporation RL currently has an Earnings ESP of +3.68% and a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Hanesbrands Inc. (HBI) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

To read this article on Zacks.com click here.