HCA Healthcare's (HCA) Q2 Earnings Beat Estimates, Fall Y/Y

HCA Healthcare, Inc. HCA reported second-quarter 2020 adjusted earnings of $1.50 per share. The Zacks Consensus Estimate was of a loss of 94 cents per share. However, the bottom line declined 32.1% year over year due to lower admissions.

Quarterly Details

HCA Healthcare’s revenues of $11.1 billion beat the Zacks Consensus Estimate by 17.7%. However, the top line declined 12.2% from the year-ago period.

Same facility equivalent admissions tumbled 20.1% year over year while same facility admissions dropped 12.8% year over year. However, same facility revenue per equivalent admission grew 10% year over year.

Same facility inpatient surgeries and same facility outpatient surgeries slid 15.7% and 32.6%, respectively, year over year.

Patient volumes across most services contracted in April due to strict adherence to state and local policies for restricting the spread of COVID-19. However, patient volumes improved in May and June as states began to resume and allow non-emergent procedures.

Salaries and benefits, supplies and other operating expenses decreased 10.6% year over year to $9.2 billion.

Adjusted EBITDA totaled $2.6 billion, up 16.3% year over year.

As of Jun 30, 2020, HCA Healthcare operated 186 hospitals.

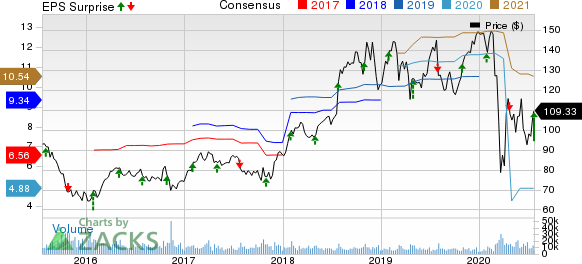

HCA Healthcare, Inc. Price, Consensus and EPS Surprise

HCA Healthcare, Inc. price-consensus-eps-surprise-chart | HCA Healthcare, Inc. Quote

Financial Update

As of Jun 30, 2020, the company had cash and cash equivalents of $4.6 billion, total debt of $30.9 billion and total assets worth $48.7 billion.

In the reported quarter, capex came in at $745 million minus acquisitions.

Cash flows provided by operating activities were $8.72 billion, up 336.8% year over year.

As of Jun 30, 2020, HCA Healthcare had $7.72 billion of availability under its credit facilities.

Zacks Rank

HCA Healthcare carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases From Medical Sector

Some stocks worth considering from the medical sector with a perfect mix of elements to surpass estimates in the upcoming quarterly releases are as follows:

Centene Corporation CNC currently has an Earnings ESP of +0.88% and a Zacks Rank #3. The company is scheduled to release second-quarter earnings on Jul 28.

Anthem, Inc. ANTM is slated to announce second-quarter earnings on Jul 29. The stock has an Earnings ESP of +3.73% and a Zacks Rank #2 at present.

Molina Healthcare, Inc. MOH is set to report second-quarter earnings on Jul 30. The stock is currently a #2 Ranked player and has an Earnings ESP of +4.08%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research