HCI Group (HCI) Shares Down on Q2 Earnings and Revenue Miss

Shares of HCI Group HCI lost 3.9% in the last two trading sessions after the insurer posted a wider-than-estimated loss for the second quarter of 2022. The top line too missed estimates.

Second-quarter 2022 operating loss per share was 71 cents compared with the Zacks Consensus Estimate of a loss of 20 cents. In the year-ago quarter, the company had reported earnings of 11 cents per share.

The results reflect soft Homeowners Choice results and escalating costs.

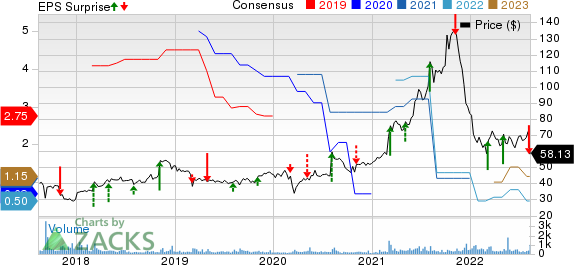

HCI Group, Inc. Price, Consensus and EPS Surprise

HCI Group, Inc. price-consensus-eps-surprise-chart | HCI Group, Inc. Quote

Behind the Headlines

Gross premiums written of $186.2 million rose 0.6% year over year, driven by the continued growth of TypTap Insurance Company, partially offset by soft Homeowners Choice.

Homeowners Choice gross written premiums declined as the quota share with United Property and Casualty (UPC) transitioned to TypTap.

Operating revenues increased 24.1% year over year to about $126 million on account of the rise in net premiums earned, net investment income and policy fee income. The top line missed the Zacks Consensus Estimate by 3.6%.

Net investment income of $3.7 million increased 39.8% year over year. The upside was driven by higher income from fixed maturity securities, offset by reductions in income from limited partnership investments.

Total expenses escalated 42.6% year over year to $137.5 million due to increased losses and loss adjustment expenses, policy acquisition and other underwriting expenses, general and administrative personnel expenses and other operating expenses.

The 55.3% year-over-year rise in losses and loss adjustment expenses was the result of premium base as well as inflation and prior year loss development. Inflation accelerated in the quarter, which led to an increase in gross loss ratio.

Financial Update

HCI Group exited the second quarter with cash and cash equivalents of $631.3 million, which dropped 42.8% from the 2021-end level. Total investments increased nearly threefold from 2021 end to $534.5 million at quarter end.

Long-term debt of $211.6 million increased more than fourfold from the 2021-end figure.

As of Jun 30, 2022, total shareholders’ equity totaled $292.5 million, which decreased 26.1% from the level at 2021 end.

Zacks Rank

HCI Group currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Property and Casualty Insurers

Of the insurance industry players that have reported second-quarter results so far, The Travelers Companies TRV and RLI Corporation RLI beat the respective Zacks Consensus Estimate for earnings, while The Progressive Corporation PGR met the mark.

Travelers’ core income of $2.57 per share beat the Zacks Consensus Estimate by 28.5% but decreased 26% year over year. Total revenues increased 7% year over year, primarily due to higher premiums, and beat the consensus estimate by 1.8%. Net written premiums increased 11%, driven by strong retention rates and positive renewal premium changes across all the segments. Underwriting gain of $113 million decreased 65% year over year in the reported quarter.

Travelers’ combined ratio deteriorated 300 bps year over year to 98.3 due to higher catastrophe losses and a higher underlying combined ratio.

RLI’s operating earnings of $1.49 per share beat the Zacks Consensus Estimate by 6.1% and improved 36.7% from the prior-year quarter. Operating revenues were $301.3 million, up 16.9% year over year, driven by 17.3% higher net premiums earned and 10.5% higher net investment income. The top line beat the Zacks Consensus Estimate of $276 million by 0.9%.

RLI’s underwriting income of $56 million increased 53%, primarily due to the strong performance of the Property and Surety segments. The combined ratio improved 460 bps year over year to 80.2.

Progressive’s earnings per share of 95 cents came in line with the Zacks Consensus Estimate. The bottom line declined 37.1% year over year. Progressive’s net premiums written were $12.4 billion in the quarter, up 8% from $11.7 billion a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research