Is HCP, Inc. (HCP) a Buy?

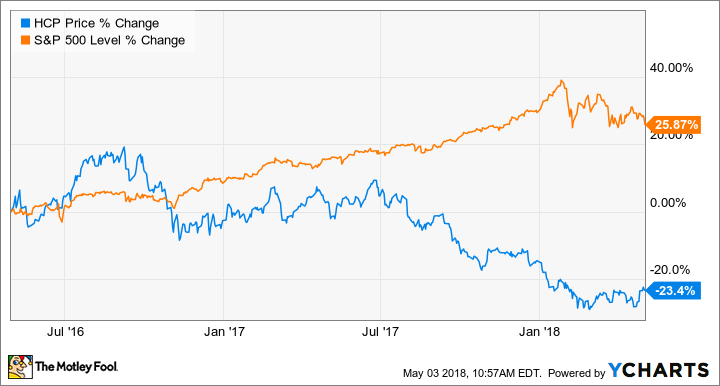

Healthcare real estate investment trust HCP (NYSE: HCP) hasn't exactly been a high-performing stock recently. In fact, while the S&P 500 has risen 26% over the past two years, HCP has fallen 23%.

However, this decline is due to factors such as rising interest rates and oversupply of certain properties -- things that have little to do with the company's long-term growth potential. Here's a closer look at why HCP has performed so poorly, and why it could be worth a look for long-term investors now.

The growing senior citizen population is a major tailwind for HCP. Image source: Getty Images.

Some short-term headwinds

First, the bad. There's significant pressure right now on the real estate sector in general, as well as healthcare REITs in particular.

Rising interest rates tend to put downward pressure on income-focused investments like REITs, which is why the sector has significantly underperformed the overall stock market during the past few years. As interest rates continue to rise (especially if they do so faster than expected), this pressure could continue.

As far as healthcare-specific headwinds, it's no secret that healthcare is a big market opportunity in the U.S., especially in regards to senior citizens. Well, with any big market opportunity, companies large and small try to capitalize, and there are two main ways to do this: buy existing properties or build new ones. Thanks to a combination of cheap capital and high property valuations over the past few years, it has been cheaper to build than to buy in many cases.

This has led to an oversupply of certain types of healthcare properties, particularly senior housing, which is HCP's largest property category. Oversupply leads to lower occupancy and a loss of pricing power, which is a big reason for the decline in HCP and other healthcare REITs. In HCP's case, its same-property senior housing operating portfolio (SHOP) net operating income declined by 6.4% over the past year.

But an amazing long-term opportunity

These headwinds could certainly weigh on HCP's performance over the short term, but it's important not to lose sight of the amazing long-term potential of healthcare real estate.

For starters, the senior citizen population is expected to explode over the next several decades, which should help take care of any oversupply in the market.

During the 10-year period from 2020-2030 alone, the 75-and-older population is expected to grow by 50%. This age group will drive demand for senior housing. It also spends far more than the general population on healthcare. This is a big reason healthcare expenditures are expected to climb by $2.3 trillion by 2025.

Additionally, the healthcare real estate market is still in the early days of REIT consolidation. Only about 15% of the $1.1 trillion of healthcare real estate in the U.S. is REIT-owned, with no company having more than a 3% market share. This leaves 85% of the existing inventory, or about $930 billion worth of healthcare properties that could be acquisition opportunities, and there's a particularly large amount of medical offices and life science properties that aren't owned by REITs yet.

In a nutshell, in addition to the vast opportunity to develop new properties over the coming decades, there's a massive opportunity to grow through value-adding acquisitions as well.

Finally, HCP has done an excellent job of transforming its portfolio into a high-quality collection of private-pay healthcare assets and improving its overall financial condition. In 2016, the company spun off its skilled nursing portfolio into a new REIT called Quality Care Properties. And since then, HCP has strategically disposed of assets to reduce concentration in its top tenants and to get rid of underperforming properties, an initiative that is still underway in 2018.

I mentioned earlier that HCP's senior housing operating income is down by more than 6% over the past year, but it's important to realize that this was almost entirely driven by properties set to be disposed of in 2018 or transitioned to new operators.

And a well-covered 6.3% yield while you wait

As a final point, HCP is an excellent income stock, and should get even better going forward. Before the QCP spin-off, HCP had a quarter-century track record of dividend increases, and once its strategic moves are complete, I would be surprised if the company didn't start boosting its payout again.

After all, the current 6.3% dividend yield represents just 82% of the company's expected 2018 funds from operations, a modest payout for a REIT. And with the growth opportunities ahead, there could be significantly more money available to pay out in the coming years.

More From The Motley Fool

Matthew Frankel owns shares of HCP. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.