HealthEquity (NASDAQ:HQY) Shareholders Have Enjoyed An Impressive 205% Share Price Gain

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For instance the HealthEquity, Inc. (NASDAQ:HQY) share price is 205% higher than it was three years ago. How nice for those who held the stock! On top of that, the share price is up 43% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

See our latest analysis for HealthEquity

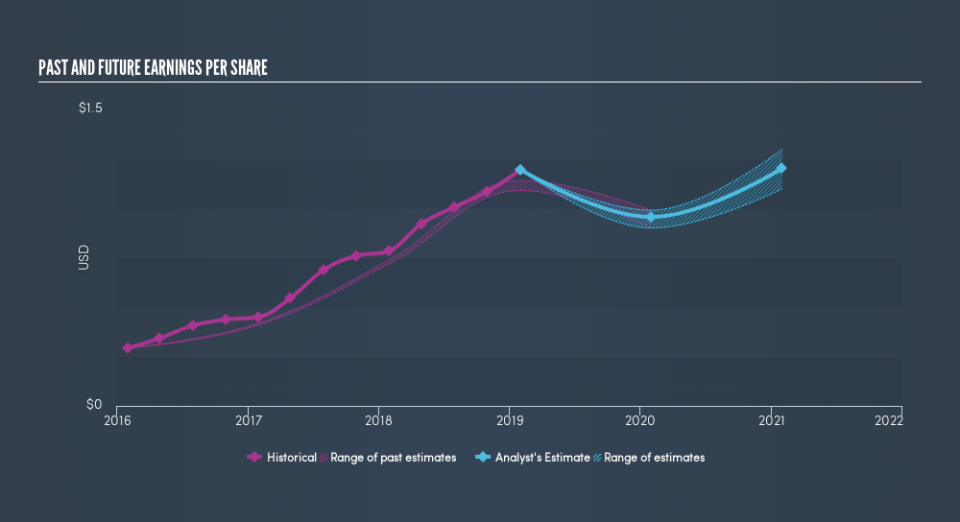

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

HealthEquity was able to grow its EPS at 60% per year over three years, sending the share price higher. The average annual share price increase of 45% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. Of course, with a P/E ratio of 64.56, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that HealthEquity has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling HealthEquity stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, HealthEquity's total shareholder return last year was 21%. That falls short of the 45% it has made, for shareholders, each year, over three years. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course HealthEquity may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.