Hedge Fund Sentiment Is Stagnant On Oppenheimer Holdings Inc. (OPY)

As we already know from media reports and hedge fund investor letters, many hedge funds lost money in October, blaming macroeconomic conditions and unpredictable events that hit several sectors, with healthcare among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Oppenheimer Holdings Inc. (NYSE:OPY) in this article.

Hedge fund interest in Oppenheimer Holdings Inc. (NYSE:OPY) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren't the only variables you need to analyze to decipher hedge funds' perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That's why at the end of this article we will examine companies such as Synergy Pharmaceuticals Inc (NASDAQ:SGYP), Nuveen Floating Rate Income Opportuntiy Fund (NYSE:JRO), and Verrica Pharmaceuticals Inc. (NASDAQ:VRCA) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

[caption id="attachment_30621" align="aligncenter" width="487"]

Cliff Asness of AQR Capital Management[/caption]

We're going to take a peek at the new hedge fund action regarding Oppenheimer Holdings Inc. (NYSE:OPY).

How are hedge funds trading Oppenheimer Holdings Inc. (NYSE:OPY)?

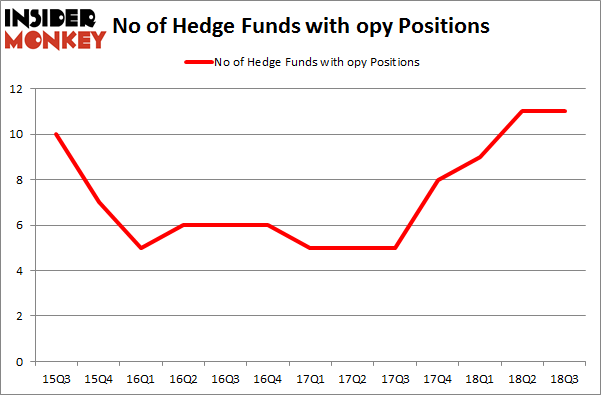

At Q3's end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in OPY heading into this year. With hedgies' capital changing hands, there exists an "upper tier" of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons's Renaissance Technologies has the largest position in Oppenheimer Holdings Inc. (NYSE:OPY), worth close to $12.2 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Noam Gottesman of GLG Partners, with a $8.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions comprise Cliff Asness's AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital and D. E. Shaw's D E Shaw.

Since Oppenheimer Holdings Inc. (NYSE:OPY) has witnessed a decline in interest from the smart money, logic holds that there were a few funds that slashed their positions entirely heading into Q3. At the top of the heap, Chuck Royce's Royce & Associates sold off the biggest investment of the 700 funds followed by Insider Monkey, comprising close to $3 million in stock, and Matthew Hulsizer's PEAK6 Capital Management was right behind this move, as the fund cut about $0.4 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Oppenheimer Holdings Inc. (NYSE:OPY) but similarly valued. We will take a look at Synergy Pharmaceuticals Inc (NASDAQ:SGYP), Nuveen Floating Rate Income Opportuntiy Fund (NYSE:JRO), Verrica Pharmaceuticals Inc. (NASDAQ:VRCA), and Republic First Bancorp, Inc. (NASDAQ:FRBK). This group of stocks' market values resemble OPY's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position SGYP,9,18499,2 JRO,6,5830,3 VRCA,8,83168,1 FRBK,8,47232,0 Average,7.75,38682,1.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $35 million in OPY's case. Synergy Pharmaceuticals Inc (NASDAQ:SGYP) is the most popular stock in this table. On the other hand Nuveen Floating Rate Income Opportuntiy Fund (NYSE:JRO) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Oppenheimer Holdings Inc. (NYSE:OPY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index