Here is Hedge Funds’ 12th Most Popular Stock Pick

Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (youve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses dont follow. Small caps are where they can generate significant outperformance. That's why we pay special attention to hedge fund activity in these stocks.

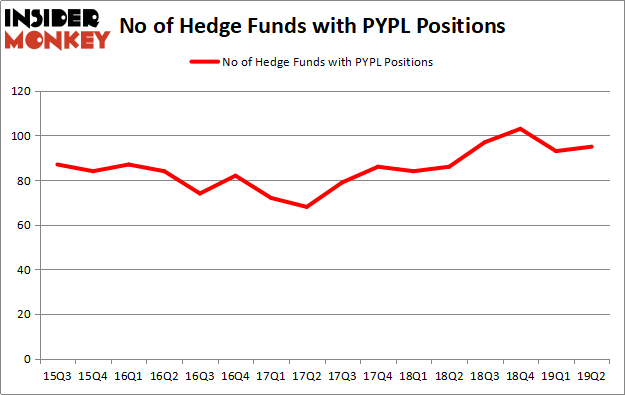

Paypal Holdings Inc (NASDAQ:PYPL) was in 95 hedge funds' portfolios at the end of June. PYPL investors should pay attention to an increase in activity from the world's largest hedge funds in recent months. There were 93 hedge funds in our database with PYPL holdings at the end of the previous quarter. Our calculations also showed that PYPLranks 12th among the 30 most popular stocks among hedge funds.

In the financial world there are dozens of methods stock market investors can use to assess stocks. Some of the most underrated methods are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a very impressive margin (see the details here). Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy outperformed the broader market indices in down markets as well.

Let's take a look at the latest hedge fund action regarding Paypal Holdings Inc (NASDAQ:PYPL).

How are hedge funds trading Paypal Holdings Inc (NASDAQ:PYPL)?

Heading into the third quarter of 2019, a total of 95 of the hedge funds tracked by Insider Monkey were long this stock, a change of 2% from the previous quarter. On the other hand, there were a total of 86 hedge funds with a bullish position in PYPL a year ago. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital has the number one position in Paypal Holdings Inc (NASDAQ:PYPL), worth close to $485.4 million, corresponding to 1.1% of its total 13F portfolio. On Arrowstreet Capital's heels is Third Point, led by Dan Loeb, holding a $400.6 million position; 4.7% of its 13F portfolio is allocated to the stock. Some other members of the smart money that hold long positions include Philippe Laffont's Coatue Management, and Alex Sacerdote's Whale Rock Capital Management.

As industrywide interest jumped, some big names have jumped into Paypal Holdings Inc (NASDAQ:PYPL) headfirst. Junto Capital Management, managed by James Parsons, established the largest position in Paypal Holdings Inc (NASDAQ:PYPL). Junto Capital Management had $46.7 million invested in the company at the end of the quarter. Richard Chilton's Chilton Investment Company also made a $36.5 million investment in the stock during the quarter. The following funds were also among the new PYPL investors: John Overdeck and David Siegel's Two Sigma Advisors, Matthew Tewksbury's Stevens Capital Management, and Alexander Mitchell's Scopus Asset Management.

Let's go over hedge fund activity in other stocks similar to Paypal Holdings Inc (NASDAQ:PYPL). We will take a look at NIKE, Inc. (NYSE:NKE), Medtronic plc (NYSE:MDT), BHP Group (NYSE:BBL), and Honeywell International Inc. (NYSE:HON). All of these stocks' market caps resemble PYPL's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NKE,51,1918137,-2 MDT,49,2317404,-1 BBL,20,1040801,-1 HON,56,2476978,0 Average,44,1938330,-1 [/table]

View table hereif you experience formatting issues.

As you can see these stocks had an average of 44 hedge funds with bullish positions and the average amount invested in these stocks was $1938 million. That figure was $3857 million in PYPL's case. Honeywell International Inc. (NYSE:HON) is the most popular stock in this table. On the other hand BHP Billiton plc (NYSE:BBL) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Paypal Holdings Inc (NASDAQ:PYPL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PYPL wasn't nearly assuccessful as these 20 stocks and hedge funds that were betting on PYPL were disappointed as the stock returned -9.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fishers Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019