Hedge Funds Aren’t Crazy About Mine Safety Appliances (MSA) Anymore

At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we've gathered as a result gives us access to a wealth of collective knowledge based on these firms' portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Mine Safety Appliances (NYSE:MSA) makes for a good investment right now.

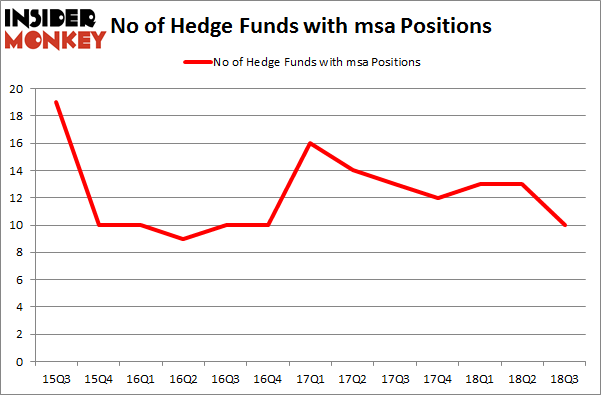

Mine Safety Appliances (NYSE:MSA) has experienced a decrease in hedge fund sentiment in recent months. MSA was in 10 hedge funds' portfolios at the end of September. There were 13 hedge funds in our database with MSA positions at the end of the previous quarter. Our calculations also showed that msa isn't among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of formulas investors have at their disposal to appraise stocks. A pair of the most underrated formulas are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the elite hedge fund managers can outpace their index-focused peers by a very impressive margin (see the details here).

Let's take a peek at the fresh hedge fund action regarding Mine Safety Appliances (NYSE:MSA).

Hedge fund activity in Mine Safety Appliances (NYSE:MSA)

At Q3's end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MSA over the last 13 quarters. With hedgies' positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Select Equity Group held the most valuable stake in Mine Safety Appliances (NYSE:MSA), which was worth $33.7 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $15.3 million worth of shares. Moreover, AQR Capital Management, PDT Partners, and GLG Partners were also bullish on Mine Safety Appliances (NYSE:MSA), allocating a large percentage of their portfolios to this stock.

Because Mine Safety Appliances (NYSE:MSA) has faced a decline in interest from the aggregate hedge fund industry, we can see that there is a sect of hedgies that slashed their positions entirely heading into Q3. Intriguingly, Ken Grossman and Glen Schneider's SG Capital Management said goodbye to the biggest position of all the hedgies tracked by Insider Monkey, comprising an estimated $15.1 million in stock, and Israel Englander's Millennium Management was right behind this move, as the fund dumped about $7.3 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 3 funds heading into Q3.

Let's go over hedge fund activity in other stocks - not necessarily in the same industry as MSA Safety Incorporated (NYSE:MSA) but similarly valued. These stocks are J2 Global Inc (NASDAQ:JCOM), Eagle Materials, Inc. (NYSE:EXP), New Jersey Resources Corp (NYSE:NJR), and Portland General Electric Company (NYSE:POR). This group of stocks' market caps match MSA's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position JCOM,17,207951,4 EXP,32,816135,6 NJR,12,65883,-2 POR,16,269447,0 Average,19.25,339854,2 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $340 million. That figure was $66 million in MSA's case. Eagle Materials, Inc. (NYSE:EXP) is the most popular stock in this table. On the other hand New Jersey Resources Corp (NYSE:NJR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks MSA Safety Incorporated (NYSE:MSA) is even less popular than NJR. Considering that hedge funds aren't fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn't behind this stock. This isn't necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index