Hedge Funds Aren’t Crazy About Tenable Holdings, Inc. (TENB) Anymore

Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That's why we weren't surprised when hedge funds’ top 20 large-cap stock picks generated a return of 24.4% during the first 9 months of 2019 and outperformed the broader market benchmark by 4 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

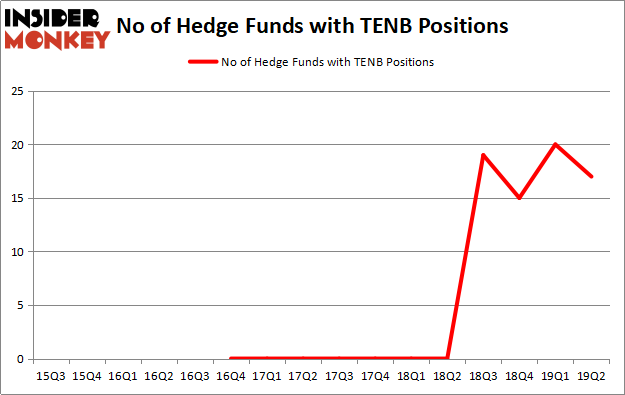

Is Tenable Holdings, Inc. (NASDAQ:TENB) a first-rate investment today? Hedge funds are in a bearish mood. The number of bullish hedge fund positions retreated by 3 in recent months. Our calculations also showed that TENB isn't among the 30 most popular stocks among hedge funds (see the video below). TENB was in 17 hedge funds' portfolios at the end of the second quarter of 2019. There were 20 hedge funds in our database with TENB positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are several signals investors have at their disposal to appraise publicly traded companies. A pair of the most innovative signals are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top money managers can trounce the S&P 500 by a healthy margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let's analyze the fresh hedge fund action encompassing Tenable Holdings, Inc. (NASDAQ:TENB).

How have hedgies been trading Tenable Holdings, Inc. (NASDAQ:TENB)?

Heading into the third quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TENB over the last 16 quarters. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Sylebra Capital Management held the most valuable stake in Tenable Holdings, Inc. (NASDAQ:TENB), which was worth $72.9 million at the end of the second quarter. On the second spot was Holocene Advisors which amassed $16.6 million worth of shares. Moreover, D E Shaw, Marshall Wace LLP, and Citadel Investment Group were also bullish on Tenable Holdings, Inc. (NASDAQ:TENB), allocating a large percentage of their portfolios to this stock.

Since Tenable Holdings, Inc. (NASDAQ:TENB) has witnessed bearish sentiment from the aggregate hedge fund industry, it's safe to say that there exists a select few hedge funds that elected to cut their positions entirely heading into Q3. Intriguingly, Zachary Miller's Parian Global Management sold off the biggest position of the "upper crust" of funds followed by Insider Monkey, comprising an estimated $6.5 million in stock, and Bijan Modanlou, Joseph Bou-Saba, and Jayaveera Kodali's Alta Park Capital was right behind this move, as the fund cut about $6 million worth. These moves are interesting, as total hedge fund interest was cut by 3 funds heading into Q3.

Let's now review hedge fund activity in other stocks similar to Tenable Holdings, Inc. (NASDAQ:TENB). We will take a look at Covetrus, Inc. (NASDAQ:CVET), Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB), Cogent Communications Holdings, Inc. (NASDAQ:CCOI), and Fulton Financial Corp (NASDAQ:FULT). This group of stocks' market caps match TENB's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CVET,20,426961,2 OMAB,7,54603,1 CCOI,18,286498,-1 FULT,14,34700,-2 Average,14.75,200691,0 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $201 million. That figure was $147 million in TENB's case. Covetrus, Inc. (NASDAQ:CVET) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB) is the least popular one with only 7 bullish hedge fund positions. Tenable Holdings, Inc. (NASDAQ:TENB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TENB wasn't nearly as popular as these 20 stocks and hedge funds that were betting on TENB were disappointed as the stock returned -21.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019