Hedge Funds Aren’t Crazy About Cna Financial Corporation (NYSE:CNA) Anymore

During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Cna Financial Corporation (NYSE:CNA) and see how the stock is affected by the recent hedge fund activity.

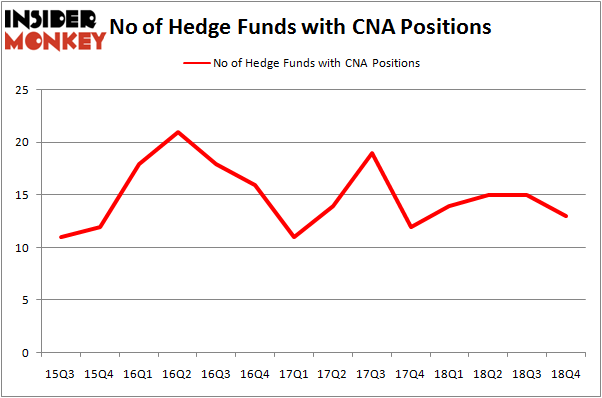

Cna Financial Corporation (NYSE:CNA) shareholders have witnessed a decrease in hedge fund sentiment of late. CNA was in 13 hedge funds' portfolios at the end of December. There were 15 hedge funds in our database with CNA positions at the end of the previous quarter. Our calculations also showed that CNA isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let's take a gander at the recent hedge fund action regarding Cna Financial Corporation (NYSE:CNA).

How have hedgies been trading Cna Financial Corporation (NYSE:CNA)?

Heading into the first quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CNA over the last 14 quarters. With hedgies' capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons's Renaissance Technologies has the number one position in Cna Financial Corporation (NYSE:CNA), worth close to $35.9 million, corresponding to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Marshall Wace LLP, led by Paul Marshall and Ian Wace, holding a $17.4 million position; 0.2% of its 13F portfolio is allocated to the stock. Some other peers that are bullish contain Israel Englander's Millennium Management, Noam Gottesman's GLG Partners and Ken Griffin's Citadel Investment Group.

Due to the fact that Cna Financial Corporation (NYSE:CNA) has faced bearish sentiment from hedge fund managers, it's safe to say that there was a specific group of hedge funds that decided to sell off their positions entirely last quarter. Intriguingly, Andrew Feldstein and Stephen Siderow's Blue Mountain Capital dropped the biggest position of all the hedgies followed by Insider Monkey, valued at about $0.4 million in stock, and Bruce Kovner's Caxton Associates LP was right behind this move, as the fund cut about $0.3 million worth. These transactions are interesting, as total hedge fund interest fell by 2 funds last quarter.

Let's go over hedge fund activity in other stocks similar to Cna Financial Corporation (NYSE:CNA). These stocks are Henry Schein, Inc. (NASDAQ:HSIC), Garmin Ltd. (NASDAQ:GRMN), ANSYS, Inc. (NASDAQ:ANSS), and Marathon Oil Corporation (NYSE:MRO). This group of stocks' market values are closest to CNA's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position HSIC,27,1604886,5 GRMN,31,274275,4 ANSS,29,733810,3 MRO,37,746125,-2 Average,31,839774,2.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $840 million. That figure was $93 million in CNA's case. Marathon Oil Corporation (NYSE:MRO) is the most popular stock in this table. On the other hand Henry Schein, Inc. (NASDAQ:HSIC) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Cna Financial Corporation (NYSE:CNA) is even less popular than HSIC. Considering that hedge funds aren't fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn't behind this stock. This isn't necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index