Hedge Funds Are Coming Back To Nucor Corporation (NUE)

We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds' top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That's why we believe it isn't a waste of time to check out hedge fund sentiment before you invest in a stock like Nucor Corporation (NYSE:NUE).

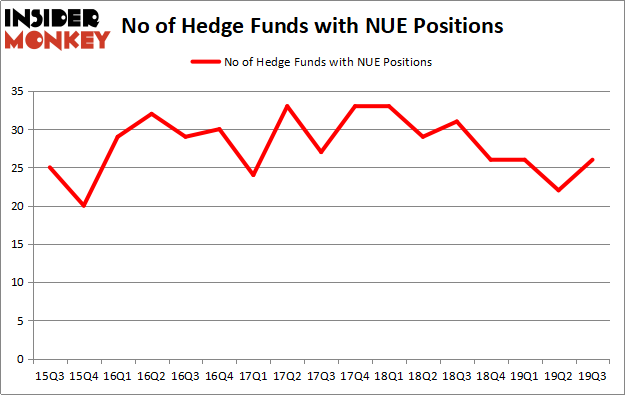

Nucor Corporation (NYSE:NUE) was in 26 hedge funds' portfolios at the end of September. NUE has experienced an increase in support from the world's most elite money managers of late. There were 22 hedge funds in our database with NUE holdings at the end of the previous quarter. Our calculations also showed that NUE isn't among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are assumed to be unimportant, old investment tools of yesteryear. While there are greater than 8000 funds in operation at the moment, We hone in on the leaders of this group, about 750 funds. These money managers shepherd the lion's share of the smart money's total asset base, and by monitoring their top investments, Insider Monkey has deciphered many investment strategies that have historically beaten the broader indices. Insider Monkey's flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

[caption id="attachment_340081" align="aligncenter" width="600"]

Phill Gross of Adage Capital Management[/caption]

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world's most bearish hedge fund that's more convinced than ever that a crash is coming, our long-short investment strategy doesn't rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds' buy/sell signals. We're going to take a glance at the fresh hedge fund action surrounding Nucor Corporation (NYSE:NUE).

How have hedgies been trading Nucor Corporation (NYSE:NUE)?

At Q3's end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the second quarter of 2019. On the other hand, there were a total of 31 hedge funds with a bullish position in NUE a year ago. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Nucor Corporation (NYSE:NUE), with a stake worth $43.3 million reported as of the end of September. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $35.7 million. Adage Capital Management, Fisher Asset Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position DSAM Partners allocated the biggest weight to Nucor Corporation (NYSE:NUE), around 0.48% of its portfolio. Neo Ivy Capital is also relatively very bullish on the stock, earmarking 0.26 percent of its 13F equity portfolio to NUE.

Consequently, key money managers were leading the bulls' herd. DSAM Partners, managed by Guy Shahar, initiated the biggest position in Nucor Corporation (NYSE:NUE). DSAM Partners had $2.5 million invested in the company at the end of the quarter. Louis Bacon's Moore Global Investments also made a $2 million investment in the stock during the quarter. The following funds were also among the new NUE investors: David Costen Haley's HBK Investments, Ben Levine, Andrew Manuel and Stefan Renold's LMR Partners, and Bruce Kovner's Caxton Associates.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as Nucor Corporation (NYSE:NUE) but similarly valued. We will take a look at W.P. Carey Inc. REIT (NYSE:WPC), Apollo Global Management, Inc. (NYSE:APO), TransUnion (NYSE:TRU), and PagSeguro Digital Ltd. (NYSE:PAGS). This group of stocks' market caps resemble NUE's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position WPC,14,38560,-2 APO,24,1733222,1 TRU,34,1040934,4 PAGS,35,1381252,5 Average,26.75,1048492,2 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $1048 million. That figure was $167 million in NUE's case. PagSeguro Digital Ltd. (NYSE:PAGS) is the most popular stock in this table. On the other hand W.P. Carey Inc. REIT (NYSE:WPC) is the least popular one with only 14 bullish hedge fund positions. Nucor Corporation (NYSE:NUE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on NUE as the stock returned 10.7% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

7 Best Alcoholic Drinks For Sore Throat, Cough, and Cold

10 Worst, Poorest, and Most Dangerous Neighborhoods in New York City