Hedge Funds Are Crazy About Nutrien Ltd. (NTR)

Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Nutrien Ltd. (NYSE:NTR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

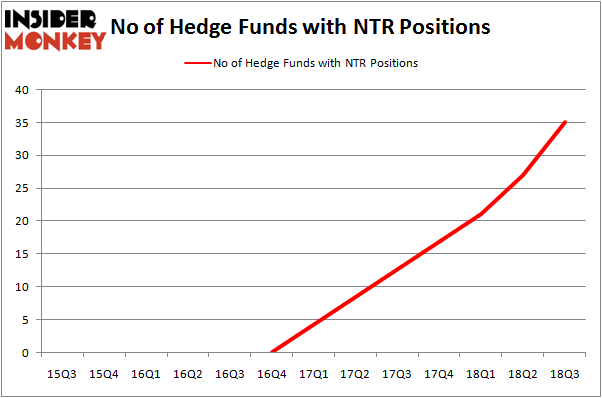

Is Nutrien Ltd. (NYSE:NTR) an attractive investment today? Investors who are in the know are buying. The number of long hedge fund bets advanced by 8 recently. Our calculations also showed that NTR isn't among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to go over the recent hedge fund action encompassing Nutrien Ltd. (NYSE:NTR).

What have hedge funds been doing with Nutrien Ltd. (NYSE:NTR)?

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NTR over the last 13 quarters. So, let's see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Nutrien Ltd. (NYSE:NTR) was held by Egerton Capital Limited, which reported holding $255.2 million worth of stock at the end of September. It was followed by Adage Capital Management with a $151.9 million position. Other investors bullish on the company included Citadel Investment Group, Millennium Management, and D E Shaw.

As aggregate interest increased, specific money managers have been driving this bullishness. SG Capital Management, managed by Ken Grossman and Glen Schneider, established the largest position in Nutrien Ltd. (NYSE:NTR). SG Capital Management had $17.4 million invested in the company at the end of the quarter. Louis Bacon's Moore Global Investments also made a $9.8 million investment in the stock during the quarter. The other funds with brand new NTR positions are Matthew Hulsizer's PEAK6 Capital Management, Nick Niell's Arrowgrass Capital Partners, and Zach Schreiber's Point State Capital.

Let's go over hedge fund activity in other stocks similar to Nutrien Ltd. (NYSE:NTR). These stocks are National Grid plc (NYSE:NGG), Public Storage (NYSE:PSA), American Electric Power Company, Inc. (NYSE:AEP), and ServiceNow Inc (NYSE:NOW). This group of stocks' market caps are similar to NTR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NGG,11,237302,-2 PSA,15,679829,-2 AEP,36,1257422,10 NOW,65,3610372,19 Average,31.75,1446231,6.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.45 billion. That figure was $818 million in NTR's case. ServiceNow Inc (NYSE:NOW) is the most popular stock in this table. On the other hand National Grid plc (NYSE:NGG) is the least popular one with only 11 bullish hedge fund positions. Nutrien Ltd. (NYSE:NTR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard NOW might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index