Hedge Funds Gave Up On Aptiv PLC (APTV) A Little Bit Too Early

Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients' money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. Nevertheless, it is also possible to identify cheap large cap stocks by following the footsteps of best performing hedge funds.

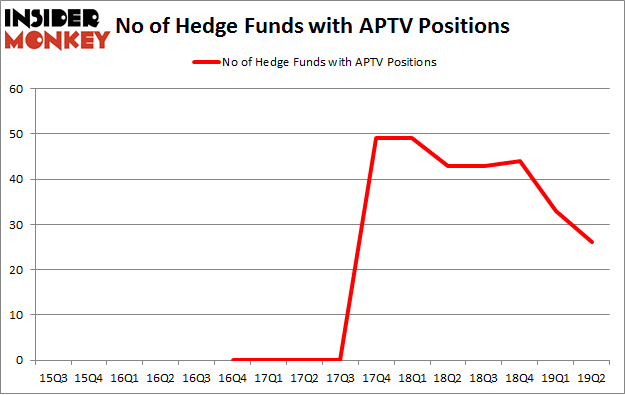

Aptiv PLC (NYSE:APTV) shareholders have witnessed a decrease in hedge fund sentiment in recent months. APTV was in 26 hedge funds' portfolios at the end of June. There were 33 hedge funds in our database with APTV holdings at the end of the previous quarter. Our calculations also showed that APTV isn't among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let's review the latest hedge fund action regarding Aptiv PLC (NYSE:APTV).

How have hedgies been trading Aptiv PLC (NYSE:APTV)?

At the end of the second quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards APTV over the last 16 quarters. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Generation Investment Management held the most valuable stake in Aptiv PLC (NYSE:APTV), which was worth $457.5 million at the end of the second quarter. On the second spot was Senator Investment Group which amassed $131.3 million worth of shares. Moreover, Impax Asset Management, Holocene Advisors, and Point72 Asset Management were also bullish on Aptiv PLC (NYSE:APTV), allocating a large percentage of their portfolios to this stock.

Due to the fact that Aptiv PLC (NYSE:APTV) has experienced a decline in interest from the smart money, it's safe to say that there is a sect of hedge funds who were dropping their entire stakes in the second quarter. Interestingly, Gabriel Plotkin's Melvin Capital Management dropped the biggest position of the "upper crust" of funds monitored by Insider Monkey, worth about $55.6 million in stock. Christopher James's fund, Partner Fund Management, also dumped its stock, about $31.1 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 7 funds in the second quarter.

Let's now review hedge fund activity in other stocks similar to Aptiv PLC (NYSE:APTV). These stocks are CoStar Group Inc (NASDAQ:CSGP), Liberty Global plc (NASDAQ:LBTYA), The Hartford Financial Services Group, Inc.(NYSE:HIG), and Arista Networks Inc (NYSE:ANET). This group of stocks' market caps are similar to APTV's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CSGP,32,1169953,0 LBTYA,27,1478573,-1 HIG,30,1125805,-7 ANET,28,411623,0 Average,29.25,1046489,-2 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $1046 million. That figure was $910 million in APTV's case. CoStar Group Inc (NASDAQ:CSGP) is the most popular stock in this table. On the other hand Liberty Global plc (NASDAQ:LBTYA) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Aptiv PLC (NYSE:APTV) is even less popular than LBTYA. Hedge funds clearly dropped the ball on APTV as the stock delivered strong returns, though hedge funds' consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on APTV as the stock returned 8.4% during the third quarter and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019