Do Hedge Funds Love CareDx, Inc. (CDNA)?

Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The one and a half month time period since the end of the third quarter is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of CareDx, Inc. (NASDAQ:CDNA).

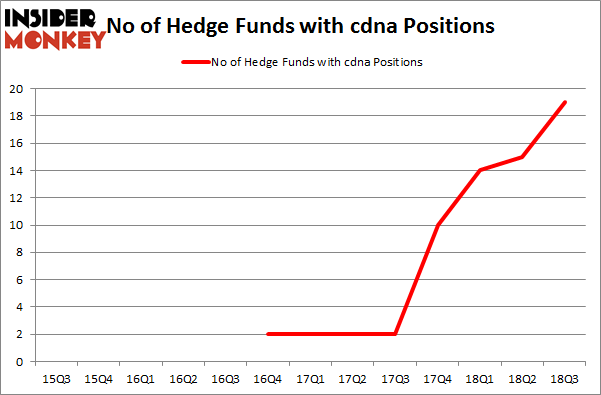

Is CareDx, Inc. (NASDAQ:CDNA) the right investment to pursue these days? The smart money is taking an optimistic view. The number of long hedge fund positions rose by 4 lately. Our calculations also showed that cdna isn't among the 30 most popular stocks among hedge funds.

In the eyes of most traders, hedge funds are perceived as slow, outdated financial tools of the past. While there are over 8,000 funds in operation today, We hone in on the aristocrats of this group, about 700 funds. These money managers preside over the lion's share of the hedge fund industry's total asset base, and by shadowing their matchless equity investments, Insider Monkey has figured out numerous investment strategies that have historically outstripped the market. Insider Monkey's flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let's take a look at the fresh hedge fund action surrounding CareDx, Inc. (NASDAQ:CDNA).

What have hedge funds been doing with CareDx, Inc. (NASDAQ:CDNA)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in CDNA at the beginning of this year. With hedgies' positions undergoing their usual ebb and flow, there exists an "upper tier" of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in CareDx, Inc. (NASDAQ:CDNA) was held by Driehaus Capital, which reported holding $20.6 million worth of stock at the end of September. It was followed by Royce & Associates with a $16.4 million position. Other investors bullish on the company included Two Sigma Advisors, 12 West Capital Management, and D E Shaw.

As industrywide interest jumped, some big names were leading the bulls' herd. BeaconLight Capital, managed by Ed Bosek, initiated the largest position in CareDx, Inc. (NASDAQ:CDNA). BeaconLight Capital had $7.5 million invested in the company at the end of the quarter. John W. Rende's Copernicus Capital Management also made a $1.9 million investment in the stock during the quarter. The other funds with brand new CDNA positions are Peter Muller's PDT Partners, Matthew Hulsizer's PEAK6 Capital Management, and Matthew Hulsizer's PEAK6 Capital Management.

Let's also examine hedge fund activity in other stocks similar to CareDx, Inc. (NASDAQ:CDNA). These stocks are Century Aluminum Co (NASDAQ:CENX), COMSCORE, Inc. (NASDAQ:SCOR), eXp World Holdings, Inc. (NASDAQ:EXPI), and Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA). This group of stocks' market values are closest to CDNA's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CENX,11,71005,-5 SCOR,13,248673,-2 EXPI,5,1449,3 LOMA,11,19866,-1 Average,10,85248,-1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $118 million in CDNA's case. COMSCORE, Inc. (NASDAQ:SCOR) is the most popular stock in this table. On the other hand eXp World Holdings, Inc. (NASDAQ:EXPI) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks CareDx, Inc. (NASDAQ:CDNA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index