Do Hedge Funds Love Noble Corporation (NE)?

We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn't mean that they don't have occasional colossal losses; they do (like Peltz's recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Noble Corporation plc (NYSE:NE).

Is Noble Corporation plc (NYSE:NE) a healthy stock for your portfolio? Money managers are taking a bearish view. The number of long hedge fund bets were cut by 1 lately. Our calculations also showed that NE isn't among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as unimportant, old financial vehicles of years past. While there are over 8,000 funds in operation today, Our researchers look at the upper echelon of this group, around 700 funds. These investment experts watch over most of the hedge fund industry's total capital, and by paying attention to their first-class investments, Insider Monkey has identified a number of investment strategies that have historically outpaced the broader indices. Insider Monkey's flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We're going to review the recent hedge fund action regarding Noble Corporation plc (NYSE:NE).

What have hedge funds been doing with Noble Corporation plc (NYSE:NE)?

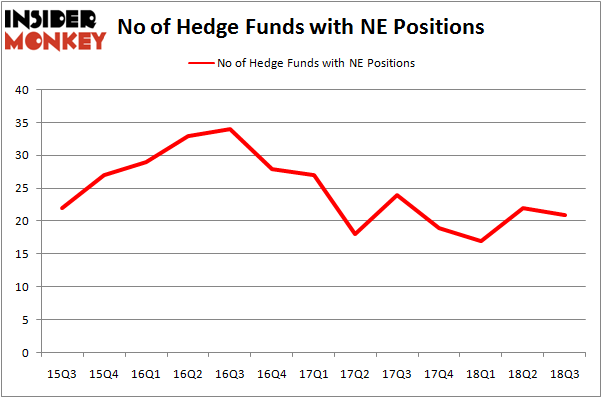

Heading into the fourth quarter of 2018, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in NE over the last 13 quarters. With the smart money's positions undergoing their usual ebb and flow, there exists an "upper tier" of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in Noble Corporation plc (NYSE:NE) was held by Firefly Value Partners, which reported holding $100 million worth of stock at the end of September. It was followed by Blue Mountain Capital with a $28.3 million position. Other investors bullish on the company included Millennium Management, DC Capital Partners, and Vertex One Asset Management.

Judging by the fact that Noble Corporation plc (NYSE:NE) has experienced declining sentiment from the entirety of the hedge funds we track, it's safe to say that there was a specific group of hedgies that elected to cut their positions entirely by the end of the third quarter. At the top of the heap, Jonathan Barrett and Paul Segal's Luminus Management dropped the biggest investment of the 700 funds followed by Insider Monkey, totaling close to $17.6 million in stock. Paul Marshall and Ian Wace's fund, Marshall Wace LLP, also said goodbye to its stock, about $12.7 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let's also examine hedge fund activity in other stocks similar to Noble Corporation plc (NYSE:NE). These stocks are Phibro Animal Health Corp (NASDAQ:PAHC), Rapid7 Inc (NASDAQ:RPD), SPS Commerce, Inc. (NASDAQ:SPSC), and IAMGOLD Corporation (NYSE:IAG). This group of stocks' market values are closest to NE's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position PAHC,21,76904,4 RPD,17,221660,3 SPSC,19,160967,-1 IAG,12,107461,-3 Average,17.25,141748,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $142 million. That figure was $260 million in NE's case. Phibro Animal Health Corp (NASDAQ:PAHC) is the most popular stock in this table. On the other hand IAMGOLD Corporation (NYSE:IAG) is the least popular one with only 12 bullish hedge fund positions. Noble Corporation plc (NYSE:NE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard PAHC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index