Hedge Funds Have Never Been This Bullish On Amkor Technology, Inc. (AMKR)

Is Amkor Technology, Inc. (NASDAQ:AMKR) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

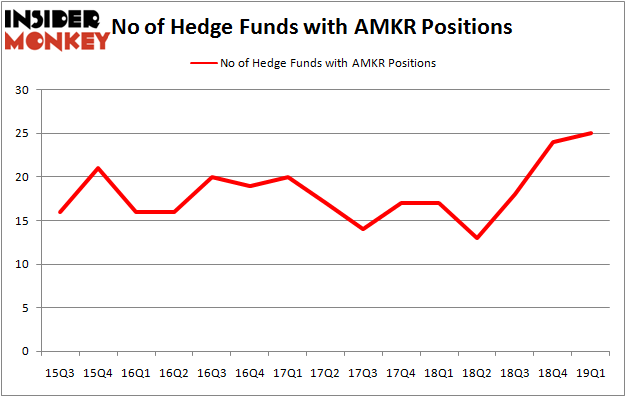

Amkor Technology, Inc. (NASDAQ:AMKR) investors should pay attention to an increase in hedge fund interest recently. Our calculations also showed that AMKR isn't among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren't comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

[caption id="attachment_745225" align="aligncenter" width="473"]

Noam Gottesman, GLG Partners[/caption]

We're going to take a glance at the recent hedge fund action surrounding Amkor Technology, Inc. (NASDAQ:AMKR).

What have hedge funds been doing with Amkor Technology, Inc. (NASDAQ:AMKR)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AMKR over the last 15 quarters. So, let's see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, D. E. Shaw's D E Shaw has the most valuable position in Amkor Technology, Inc. (NASDAQ:AMKR), worth close to $23.3 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $18.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions encompass Jim Simons's Renaissance Technologies, Cliff Asness's AQR Capital Management and John Overdeck and David Siegel's Two Sigma Advisors.

As aggregate interest increased, key hedge funds were leading the bulls' herd. GLG Partners, managed by Noam Gottesman, assembled the most valuable position in Amkor Technology, Inc. (NASDAQ:AMKR). GLG Partners had $1.8 million invested in the company at the end of the quarter. Minhua Zhang's Weld Capital Management also made a $0.8 million investment in the stock during the quarter. The following funds were also among the new AMKR investors: Matthew Hulsizer's PEAK6 Capital Management and Nick Thakore's Diametric Capital.

Let's now take a look at hedge fund activity in other stocks similar to Amkor Technology, Inc. (NASDAQ:AMKR). These stocks are Ladder Capital Corp (NYSE:LADR), Cision Ltd. (NYSE:CISN), Upwork Inc. (NASDAQ:UPWK), and Groupon Inc (NASDAQ:GRPN). This group of stocks' market caps are closest to AMKR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position LADR,15,53995,1 CISN,17,51296,0 UPWK,9,10600,2 GRPN,26,405688,2 Average,16.75,130395,1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $130 million. That figure was $89 million in AMKR's case. Groupon Inc (NASDAQ:GRPN) is the most popular stock in this table. On the other hand Upwork Inc. (NASDAQ:UPWK) is the least popular one with only 9 bullish hedge fund positions. Amkor Technology, Inc. (NASDAQ:AMKR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately AMKR wasn't nearly as popular as these 20 stocks and hedge funds that were betting on AMKR were disappointed as the stock returned -21.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index