Hedge Funds Have Never Been This Bullish On Assurant, Inc. (AIZ)

Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds' and successful investors' positions as of the end of the first quarter. You can find write-ups about an individual hedge fund's trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Assurant, Inc. (NYSE:AIZ) based on that data.

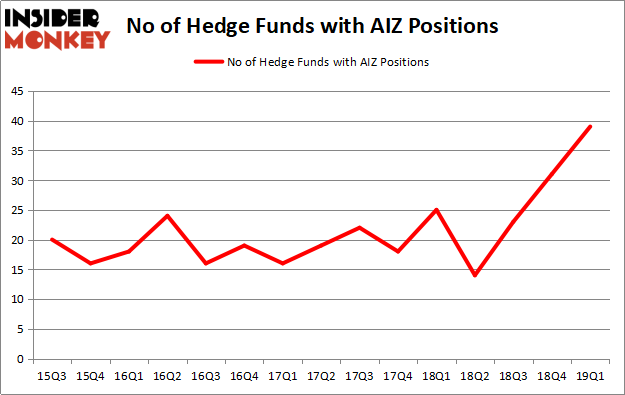

Is Assurant, Inc. (NYSE:AIZ) ready to rally soon? Hedge funds are buying. The number of bullish hedge fund bets inched up by 8 recently. Our calculations also showed that AIZ isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We're going to view the new hedge fund action regarding Assurant, Inc. (NYSE:AIZ).

Hedge fund activity in Assurant, Inc. (NYSE:AIZ)

At the end of the first quarter, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards AIZ over the last 15 quarters. With hedge funds' sentiment swirling, there exists a few notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to Insider Monkey's hedge fund database, Jeffrey Talpins's Element Capital Management has the largest position in Assurant, Inc. (NYSE:AIZ), worth close to $143.2 million, accounting for 4.4% of its total 13F portfolio. Sitting at the No. 2 spot is Samlyn Capital, led by Robert Pohly, holding a $78.9 million position; 1.9% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism encompass Dmitry Balyasny's Balyasny Asset Management, Phill Gross and Robert Atchinson's Adage Capital Management and Cliff Asness's AQR Capital Management.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls' herd. York Capital Management, managed by James Dinan, created the largest position in Assurant, Inc. (NYSE:AIZ). York Capital Management had $23.7 million invested in the company at the end of the quarter. Matthew Halbower's Pentwater Capital Management also initiated a $9.5 million position during the quarter. The other funds with brand new AIZ positions are Ron Bobman's Capital Returns Management, Daniel S. Och's OZ Management, and Simon Sadler's Segantii Capital.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Assurant, Inc. (NYSE:AIZ) but similarly valued. We will take a look at Nektar Therapeutics (NASDAQ:NKTR), BOK Financial Corporation (NASDAQ:BOKF), Caesars Entertainment Corp (NASDAQ:CZR), and Ciena Corporation (NYSE:CIEN). This group of stocks' market caps are closest to AIZ's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NKTR,17,252184,-3 BOKF,16,215649,-3 CZR,57,3150352,-1 CIEN,30,510894,1 Average,30,1032270,-1.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1032 million. That figure was $618 million in AIZ's case. Caesars Entertainment Corp (NASDAQ:CZR) is the most popular stock in this table. On the other hand BOK Financial Corporation (NASDAQ:BOKF) is the least popular one with only 16 bullish hedge fund positions. Assurant, Inc. (NYSE:AIZ) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on AIZ as the stock returned 6.8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index