Hedge Funds Have Never Been This Bullish On Integra Lifesciences Holdings Corp (IART)

After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms' equity portfolios as of June 28. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Integra Lifesciences Holdings Corp (NASDAQ:IART).

Integra Lifesciences Holdings Corp (NASDAQ:IART) investors should be aware of an increase in activity from the world's largest hedge funds lately. Our calculations also showed that IART isn't among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you'd ask most stock holders, hedge funds are seen as underperforming, outdated financial tools of years past. While there are greater than 8000 funds with their doors open today, Our experts choose to focus on the crème de la crème of this club, about 750 funds. Most estimates calculate that this group of people control the majority of the hedge fund industry's total asset base, and by tailing their best stock picks, Insider Monkey has figured out various investment strategies that have historically outstripped Mr. Market. Insider Monkey's flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

We're going to check out the fresh hedge fund action surrounding Integra Lifesciences Holdings Corp (NASDAQ:IART).

What have hedge funds been doing with Integra Lifesciences Holdings Corp (NASDAQ:IART)?

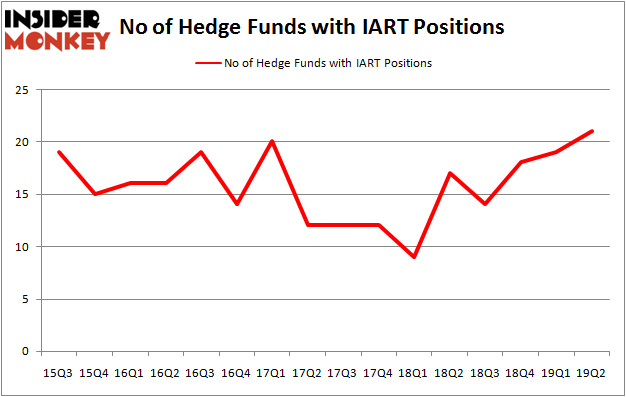

Heading into the third quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the first quarter of 2019. By comparison, 17 hedge funds held shares or bullish call options in IART a year ago. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey's hedge fund database, Fisher Asset Management, managed by Ken Fisher, holds the largest position in Integra Lifesciences Holdings Corp (NASDAQ:IART). Fisher Asset Management has a $43.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Fisher Asset Management's heels is D E Shaw, led by D. E. Shaw, holding a $24 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish consist of Paul Marshall and Ian Wace's Marshall Wace LLP, Steve Cohen's Point72 Asset Management and Phill Gross and Robert Atchinson's Adage Capital Management.

Consequently, key hedge funds have jumped into Integra Lifesciences Holdings Corp (NASDAQ:IART) headfirst. Renaissance Technologies, initiated the largest position in Integra Lifesciences Holdings Corp (NASDAQ:IART). Renaissance Technologies had $5.2 million invested in the company at the end of the quarter. Vishal Saluja and Pham Quang's Endurant Capital Management also initiated a $2.4 million position during the quarter. The following funds were also among the new IART investors: Efrem Kamen's Pura Vida Investments, Cliff Asness's AQR Capital Management, and Minhua Zhang's Weld Capital Management.

Let's go over hedge fund activity in other stocks similar to Integra Lifesciences Holdings Corp (NASDAQ:IART). We will take a look at National Fuel Gas Company (NYSE:NFG), Western Alliance Bancorporation (NYSE:WAL), MAXIMUS, Inc. (NYSE:MMS), and First Horizon National Corporation (NYSE:FHN). All of these stocks' market caps are closest to IART's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NFG,22,241410,6 WAL,27,294906,-1 MMS,22,218927,2 FHN,23,210330,7 Average,23.5,241393,3.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $241 million. That figure was $165 million in IART's case. Western Alliance Bancorporation (NYSE:WAL) is the most popular stock in this table. On the other hand National Fuel Gas Company (NYSE:NFG) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Integra Lifesciences Holdings Corp (NASDAQ:IART) is even less popular than NFG. Hedge funds clearly dropped the ball on IART as the stock delivered strong returns, though hedge funds' consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on IART as the stock returned 7.6% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019