Hedge Funds Have Never Been This Bullish On Qorvo Inc (QRVO)

The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds' top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Qorvo Inc (NASDAQ:QRVO), and what that likely means for the prospects of the company and its stock.

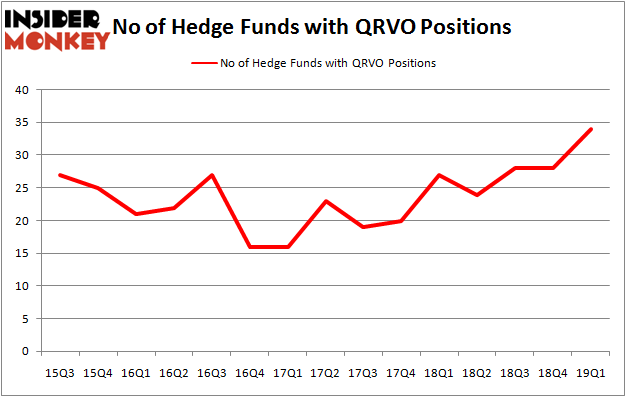

Qorvo Inc (NASDAQ:QRVO) investors should be aware of an increase in activity from the world's largest hedge funds lately. QRVO was in 34 hedge funds' portfolios at the end of the first quarter of 2019. There were 28 hedge funds in our database with QRVO positions at the end of the previous quarter. Our calculations also showed that QRVO isn't among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren't comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let's go over the new hedge fund action regarding Qorvo Inc (NASDAQ:QRVO).

How are hedge funds trading Qorvo Inc (NASDAQ:QRVO)?

At Q1's end, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 21% from the fourth quarter of 2018. By comparison, 27 hedge funds held shares or bullish call options in QRVO a year ago. With hedge funds' sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in Qorvo Inc (NASDAQ:QRVO) was held by Baupost Group, which reported holding $759.6 million worth of stock at the end of March. It was followed by Soroban Capital Partners with a $211.8 million position. Other investors bullish on the company included Fisher Asset Management, AQR Capital Management, and MD Sass.

As one would reasonably expect, key money managers have been driving this bullishness. Maplelane Capital, managed by Leon Shaulov, initiated the largest position in Qorvo Inc (NASDAQ:QRVO). Maplelane Capital had $12.2 million invested in the company at the end of the quarter. John Hurley's Cavalry Asset Management also initiated a $9.1 million position during the quarter. The following funds were also among the new QRVO investors: Jim Simons's Renaissance Technologies, Crispin Odey's Odey Asset Management Group, and Joe DiMenna's ZWEIG DIMENNA PARTNERS.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Qorvo Inc (NASDAQ:QRVO) but similarly valued. These stocks are Zscaler, Inc. (NASDAQ:ZS), Brookfield Property Partners LP (NASDAQ:BPY), Everest Re Group Ltd (NYSE:RE), and The Trade Desk, Inc. (NASDAQ:TTD). This group of stocks' market caps are similar to QRVO's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position ZS,19,301088,2 BPY,8,76215,0 RE,19,538369,-8 TTD,25,492679,9 Average,17.75,352088,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $352 million. That figure was $1201 million in QRVO's case. The Trade Desk, Inc. (NASDAQ:TTD) is the most popular stock in this table. On the other hand Brookfield Property Partners LP (NASDAQ:BPY) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Qorvo Inc (NASDAQ:QRVO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately QRVO wasn't nearly as popular as these 20 stocks and hedge funds that were betting on QRVO were disappointed as the stock returned -13.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index