Hedge Funds Have Never Been This Bullish On Vector Group Ltd (VGR)

World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients' money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It's not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It's also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

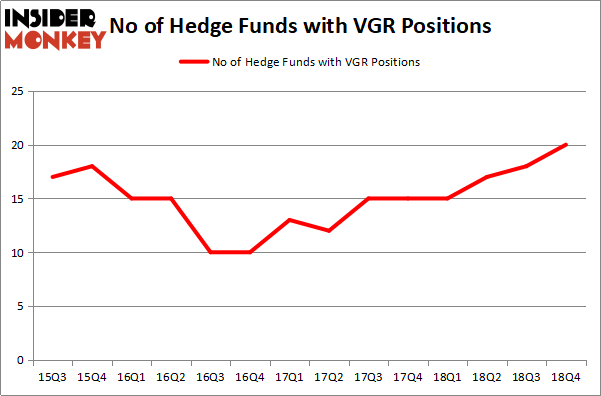

Vector Group Ltd (NYSE:VGR) shareholders have witnessed an increase in enthusiasm from smart money in recent months. VGR was in 20 hedge funds' portfolios at the end of the fourth quarter of 2018. There were 18 hedge funds in our database with VGR holdings at the end of the previous quarter. Our calculations also showed that VGR isn't among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren't comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We're going to review the new hedge fund action encompassing Vector Group Ltd (NYSE:VGR).

How have hedgies been trading Vector Group Ltd (NYSE:VGR)?

At the end of the fourth quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VGR over the last 14 quarters. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Vector Group Ltd (NYSE:VGR), which was worth $95 million at the end of the fourth quarter. On the second spot was Millennium Management which amassed $18.6 million worth of shares. Moreover, GLG Partners, Two Sigma Advisors, and Gotham Asset Management were also bullish on Vector Group Ltd (NYSE:VGR), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds have jumped into Vector Group Ltd (NYSE:VGR) headfirst. Citadel Investment Group, managed by Ken Griffin, created the most valuable position in Vector Group Ltd (NYSE:VGR). Citadel Investment Group had $10.3 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle's Springbok Capital also made a $3.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Muller's PDT Partners, Parsa Kiai's Steamboat Capital Partners, and Michael Gelband's ExodusPoint Capital.

Let's now review hedge fund activity in other stocks - not necessarily in the same industry as Vector Group Ltd (NYSE:VGR) but similarly valued. These stocks are Vanda Pharmaceuticals Inc. (NASDAQ:VNDA), Fresh Del Monte Produce Inc (NYSE:FDP), Matson, Inc. (NYSE:MATX), and Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). All of these stocks' market caps resemble VGR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position VNDA,19,376551,-1 FDP,15,42866,1 MATX,12,17426,3 KLIC,19,243689,-3 Average,16.25,170133,0 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $159 million in VGR's case. Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) is the most popular stock in this table. On the other hand Matson, Inc. (NYSE:MATX) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Vector Group Ltd (NYSE:VGR) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately VGR wasn't nearly as popular as these 15 stock and hedge funds that were betting on VGR were disappointed as the stock returned 13% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index