Hedge Funds Have Never Been This Bullish On WhiteHorse Finance, Inc. (WHF)

Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients' money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. Nevertheless, it is also possible to identify cheap large cap stocks by following the footsteps of best performing hedge funds.

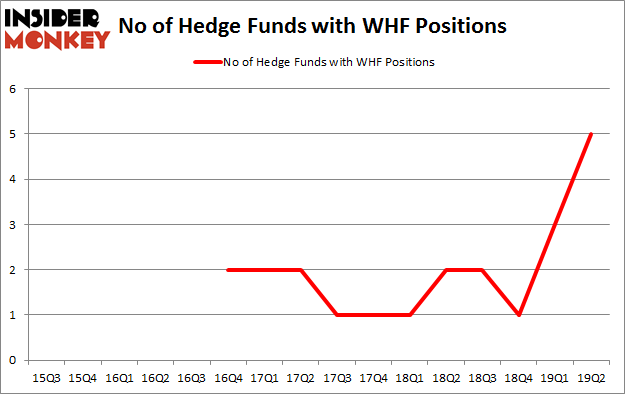

WhiteHorse Finance, Inc. (NASDAQ:WHF) has seen an increase in support from the world's most elite money managers of late. Our calculations also showed that WHF isn't among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are viewed as slow, old investment tools of years past. While there are over 8000 funds with their doors open at present, Our researchers hone in on the bigwigs of this group, about 750 funds. These investment experts oversee most of all hedge funds' total capital, and by tracking their inimitable picks, Insider Monkey has revealed several investment strategies that have historically defeated the market. Insider Monkey's flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to take a glance at the fresh hedge fund action surrounding WhiteHorse Finance, Inc. (NASDAQ:WHF).

Hedge fund activity in WhiteHorse Finance, Inc. (NASDAQ:WHF)

Heading into the third quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 67% from the previous quarter. By comparison, 2 hedge funds held shares or bullish call options in WHF a year ago. With hedge funds' positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Marshall Wace LLP was the largest shareholder of WhiteHorse Finance, Inc. (NASDAQ:WHF), with a stake worth $2.3 million reported as of the end of March. Trailing Marshall Wace LLP was Two Sigma Advisors, which amassed a stake valued at $1.4 million. Bulldog Investors, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names were breaking ground themselves. Bulldog Investors, managed by Phillip Goldstein, Andrew Dakos and Steven Samuels, assembled the most outsized position in WhiteHorse Finance, Inc. (NASDAQ:WHF). Bulldog Investors had $0.7 million invested in the company at the end of the quarter. Ken Griffin's Citadel Investment Group also initiated a $0.2 million position during the quarter.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as WhiteHorse Finance, Inc. (NASDAQ:WHF) but similarly valued. These stocks are ConforMIS, Inc. (NASDAQ:CFMS), Fang Holdings Limited (NYSE:SFUN), Craft Brew Alliance Inc (NASDAQ:BREW), and ACM Research, Inc. (NASDAQ:ACMR). This group of stocks' market caps are closest to WHF's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CFMS,7,61522,3 SFUN,6,458,-2 BREW,12,20822,1 ACMR,7,6161,5 Average,8,22241,1.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $5 million in WHF's case. Craft Brew Alliance Inc (NASDAQ:BREW) is the most popular stock in this table. On the other hand Fang Holdings Limited (NYSE:SFUN) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks WhiteHorse Finance, Inc. (NASDAQ:WHF) is even less popular than SFUN. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on WHF, though not to the same extent, as the stock returned 3.9% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019