Hedge Funds Have Never Been More Bullish On Nabriva Therapeutics plc (NBRV)

The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds' top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Nabriva Therapeutics plc (NASDAQ:NBRV), and what that likely means for the prospects of the company and its stock.

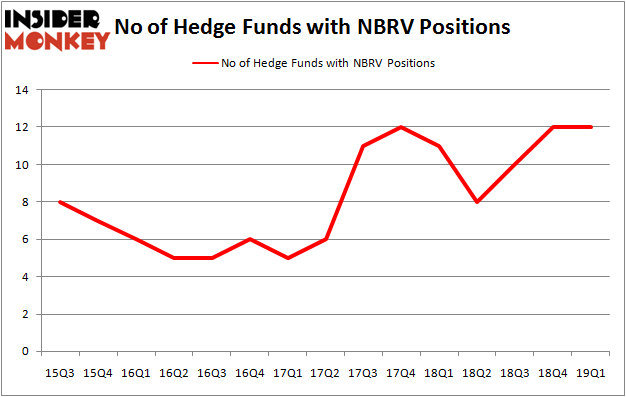

Nabriva Therapeutics plc (NASDAQ:NBRV) shares haven't seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds' portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren't the only variables you need to analyze to decipher hedge funds' perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That's why at the end of this article we will examine companies such as Ocular Therapeutix Inc (NASDAQ:OCUL), Vitamin Shoppe Inc (NYSE:VSI), and Medallion Financial Corp. (NASDAQ:MFIN) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to take a glance at the recent hedge fund action encompassing Nabriva Therapeutics plc (NASDAQ:NBRV).

What have hedge funds been doing with Nabriva Therapeutics plc (NASDAQ:NBRV)?

Heading into the second quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 11 hedge funds with a bullish position in NBRV a year ago. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, OrbiMed Advisors was the largest shareholder of Nabriva Therapeutics plc (NASDAQ:NBRV), with a stake worth $11.3 million reported as of the end of March. Trailing OrbiMed Advisors was Vivo Capital, which amassed a stake valued at $10.7 million. Frazier Healthcare Partners, Rock Springs Capital Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Laurion Capital Management. One hedge fund selling its entire position doesn't always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don't think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was D E Shaw).

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as Nabriva Therapeutics plc (NASDAQ:NBRV) but similarly valued. These stocks are Ocular Therapeutix Inc (NASDAQ:OCUL), Vitamin Shoppe Inc (NYSE:VSI), Medallion Financial Corp. (NASDAQ:MFIN), and Medley Capital Corp (NYSE:MCC). This group of stocks' market caps are closest to NBRV's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position OCUL,4,17332,0 VSI,20,51238,5 MFIN,8,5212,-2 MCC,9,19308,0 Average,10.25,23273,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $23 million. That figure was $40 million in NBRV's case. Vitamin Shoppe Inc (NYSE:VSI) is the most popular stock in this table. On the other hand Ocular Therapeutix Inc (NASDAQ:OCUL) is the least popular one with only 4 bullish hedge fund positions. Nabriva Therapeutics plc (NASDAQ:NBRV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately NBRV wasn't nearly as popular as these 20 stocks and hedge funds that were betting on NBRV were disappointed as the stock returned -9.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index