Do Hedge Funds Like Priority Technology Holdings, Inc. (PRTH)?

Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors' consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Priority Technology Holdings, Inc. (NASDAQ:PRTH).

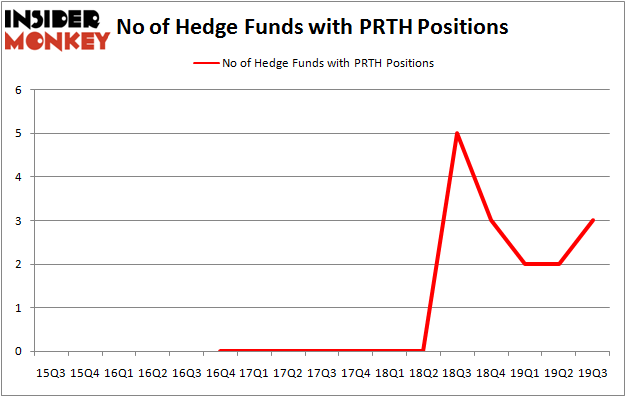

Priority Technology Holdings, Inc. (NASDAQ:PRTH) was in 3 hedge funds' portfolios at the end of the third quarter of 2019. PRTH investors should pay attention to an increase in hedge fund sentiment in recent months. There were 2 hedge funds in our database with PRTH positions at the end of the previous quarter. Our calculations also showed that PRTH isn't among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are assumed to be unimportant, old investment vehicles of yesteryear. While there are over 8000 funds trading at present, Our experts hone in on the masters of this club, about 750 funds. It is estimated that this group of investors orchestrate the lion's share of the hedge fund industry's total asset base, and by tailing their matchless equity investments, Insider Monkey has identified many investment strategies that have historically outrun the broader indices. Insider Monkey's flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

[caption id="attachment_758442" align="aligncenter" width="450"]

Michael Platt of BlueCrest Capital Mgmt.[/caption]

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world's most bearish hedge fund that's more convinced than ever that a crash is coming, our long-short investment strategy doesn't rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds' buy/sell signals. Let's check out the new hedge fund action regarding Priority Technology Holdings, Inc. (NASDAQ:PRTH).

What have hedge funds been doing with Priority Technology Holdings, Inc. (NASDAQ:PRTH)?

At the end of the third quarter, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the second quarter of 2019. By comparison, 5 hedge funds held shares or bullish call options in PRTH a year ago. With hedge funds' positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Priority Technology Holdings, Inc. (NASDAQ:PRTH) was held by BlueCrest Capital Mgmt., which reported holding $1.9 million worth of stock at the end of September. It was followed by Moore Global Investments with a $1.2 million position. The only other hedge fund that is bullish on the company was Millennium Management.

Now, some big names have jumped into Priority Technology Holdings, Inc. (NASDAQ:PRTH) headfirst. Millennium Management, managed by Israel Englander, created the largest position in Priority Technology Holdings, Inc. (NASDAQ:PRTH). Millennium Management had $0.4 million invested in the company at the end of the quarter.

Let's now review hedge fund activity in other stocks similar to Priority Technology Holdings, Inc. (NASDAQ:PRTH). These stocks are Regional Management Corp (NYSE:RM), Consolidated-Tomoka Land Co. (NYSE:CTO), DSP Group, Inc. (NASDAQ:DSPG), and PolyMet Mining Corp. (NYSE:PLM). This group of stocks' market valuations are closest to PRTH's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position RM,11,79774,0 CTO,12,46392,2 DSPG,16,53003,1 PLM,2,463,-1 Average,10.25,44908,0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $45 million. That figure was $4 million in PRTH's case. DSP Group, Inc. (NASDAQ:DSPG) is the most popular stock in this table. On the other hand PolyMet Mining Corp. (NYSE:PLM) is the least popular one with only 2 bullish hedge fund positions. Priority Technology Holdings, Inc. (NASDAQ:PRTH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately PRTH wasn't nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); PRTH investors were disappointed as the stock returned -29.9% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

25 Biggest Hedge Funds In The World

Greenlight Capital 2019 Q3 Investor Letter