Hedge Funds Are Selling Dominion Energy, Inc. (D)

The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds' movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Dominion Energy, Inc. (NYSE:D) and find out how it is affected by hedge funds' moves.

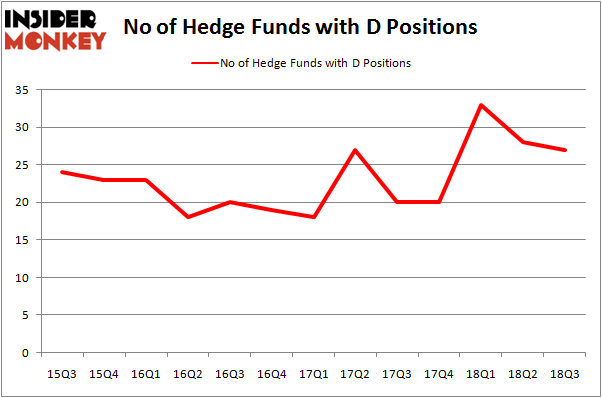

Dominion Energy, Inc. (NYSE:D) has experienced a decrease in support from the world's most elite money managers recently. D was in 27 hedge funds' portfolios at the end of the third quarter of 2018. There were 28 hedge funds in our database with D holdings at the end of the previous quarter. Our calculations also showed that D isn't among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to take a look at the recent hedge fund action encompassing Dominion Energy, Inc. (NYSE:D).

What does the smart money think about Dominion Energy, Inc. (NYSE:D)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from one quarter earlier. On the other hand, there were a total of 20 hedge funds with a bullish position in D at the beginning of this year. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Millennium Management was the largest shareholder of Dominion Energy, Inc. (NYSE:D), with a stake worth $124.2 million reported as of the end of September. Trailing Millennium Management was Luminus Management, which amassed a stake valued at $56.8 million. Adage Capital Management, Zimmer Partners, and Balyasny Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Dominion Energy, Inc. (NYSE:D) has experienced falling interest from hedge fund managers, logic holds that there exists a select few funds that slashed their entire stakes in the third quarter. At the top of the heap, John Overdeck and David Siegel's Two Sigma Advisors cut the largest position of the 700 funds watched by Insider Monkey, valued at an estimated $37.8 million in stock, and Robert Emil Zoellner's Alpine Associates was right behind this move, as the fund cut about $17.4 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 1 funds in the third quarter.

Let's go over hedge fund activity in other stocks - not necessarily in the same industry as Dominion Energy, Inc. (NYSE:D) but similarly valued. These stocks are The Blackstone Group L.P. (NYSE:BX), Marriott International Inc (NYSE:MAR), Capital One Financial Corp. (NYSE:COF), and Infosys Limited (NYSE:INFY). This group of stocks' market values resemble D's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position BX,35,615157,1 MAR,29,1552733,-13 COF,47,2509533,7 INFY,18,1130365,2 Average,32.25,1452,-0.75 [/table]

View table here if you experience formatting issues. As you can see these stocks had an average of 32.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.45 billion. That figure was $476 million in D's case. Capital One Financial Corp. (NYSE:COF) is the most popular stock in this table. On the other hand Infosys Limited (NYSE:INFY) is the least popular one with only 18 bullish hedge fund positions. Dominion Energy, Inc. (NYSE:D) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. In this regard COF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index