Hedge Funds Are Selling Dun & Bradstreet Corporation (DNB)

Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don't make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards Dun & Bradstreet Corporation (NYSE:DNB) to find out whether there were any major changes in hedge funds' views.

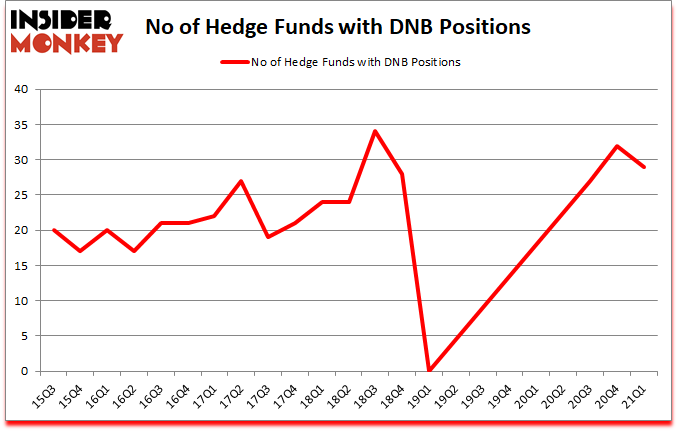

Dun & Bradstreet Corporation (NYSE:DNB) has experienced a decrease in support from the world's most elite money managers recently. Dun & Bradstreet Corporation (NYSE:DNB) was in 29 hedge funds' portfolios at the end of March. The all time high for this statistic is 34. There were 32 hedge funds in our database with DNB holdings at the end of December. Our calculations also showed that DNB isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Ricky Sandler of Eminence Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let's go over the fresh hedge fund action surrounding Dun & Bradstreet Corporation (NYSE:DNB).

Do Hedge Funds Think DNB Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the fourth quarter of 2020. By comparison, 0 hedge funds held shares or bullish call options in DNB a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Ricky Sandler's Eminence Capital has the number one position in Dun & Bradstreet Corporation (NYSE:DNB), worth close to $197.3 million, comprising 2.4% of its total 13F portfolio. Coming in second is Doug Silverman and Alexander Klabin of Senator Investment Group, with a $119.1 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish consist of Ken Griffin's Citadel Investment Group, Seth Rosen's Nitorum Capital and Robert Pitts's Steadfast Capital Management. In terms of the portfolio weights assigned to each position Bluegrass Capital Partners allocated the biggest weight to Dun & Bradstreet Corporation (NYSE:DNB), around 8.81% of its 13F portfolio. Bayberry Capital Partners is also relatively very bullish on the stock, earmarking 6.84 percent of its 13F equity portfolio to DNB.

Since Dun & Bradstreet Corporation (NYSE:DNB) has witnessed declining sentiment from hedge fund managers, we can see that there exists a select few hedge funds who were dropping their full holdings heading into Q2. Intriguingly, David MacKnight's One Fin Capital Management sold off the largest position of the 750 funds monitored by Insider Monkey, totaling close to $10 million in stock. Leon Lowenstein's fund, Lionstone Capital Management, also dumped its stock, about $9.5 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 3 funds heading into Q2.

Let's go over hedge fund activity in other stocks similar to Dun & Bradstreet Corporation (NYSE:DNB). These stocks are Dr. Reddy's Laboratories Limited (NYSE:RDY), Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH), Hubbell Incorporated (NYSE:HUBB), The Western Union Company (NYSE:WU), Teck Resources Ltd (NYSE:TECK), Watsco Inc (NYSE:WSO), and Cleveland-Cliffs Inc (NYSE:CLF). This group of stocks' market values are similar to DNB's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position RDY,12,180324,0 NCLH,34,576202,-6 HUBB,15,421137,-7 WU,28,410366,-1 TECK,30,1071508,-1 WSO,22,280163,-2 CLF,36,968204,9 Average,25.3,558272,-1.1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.3 hedge funds with bullish positions and the average amount invested in these stocks was $558 million. That figure was $835 million in DNB's case. Cleveland-Cliffs Inc (NYSE:CLF) is the most popular stock in this table. On the other hand Dr. Reddy's Laboratories Limited (NYSE:RDY) is the least popular one with only 12 bullish hedge fund positions. Dun & Bradstreet Corporation (NYSE:DNB) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DNB is 63. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 22.8% in 2021 through July 2nd and beat the market again by 6 percentage points. Unfortunately DNB wasn't nearly as popular as these 5 stocks and hedge funds that were betting on DNB were disappointed as the stock returned -8.3% since the end of March (through 7/2) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Get real-time email alerts: Follow Dun & Bradstreet Corp (NYSE:DNB)

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.