Here’s What Hedge Funds Think About Consolidated Communications Holdings Inc (CNSL)

The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Consolidated Communications Holdings Inc (NASDAQ:CNSL).

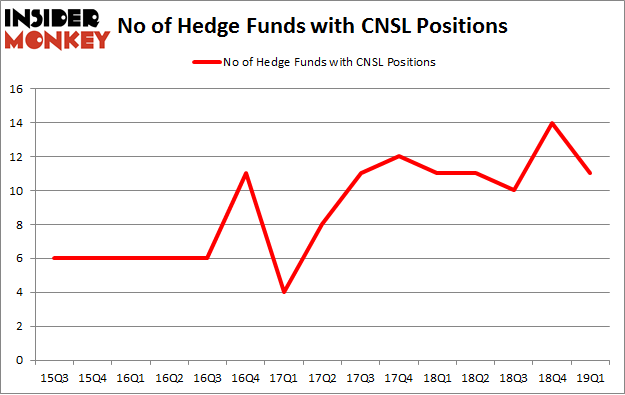

Is Consolidated Communications Holdings Inc (NASDAQ:CNSL) a buy right now? Investors who are in the know are in a pessimistic mood. The number of long hedge fund positions retreated by 3 recently. Our calculations also showed that cnsl isn't among the 30 most popular stocks among hedge funds. CNSL was in 11 hedge funds' portfolios at the end of March. There were 14 hedge funds in our database with CNSL positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let's check out the recent hedge fund action surrounding Consolidated Communications Holdings Inc (NASDAQ:CNSL).

What have hedge funds been doing with Consolidated Communications Holdings Inc (NASDAQ:CNSL)?

Heading into the second quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CNSL over the last 15 quarters. With the smart money's positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in Consolidated Communications Holdings Inc (NASDAQ:CNSL), which was worth $6.5 million at the end of the first quarter. On the second spot was Citadel Investment Group which amassed $2.6 million worth of shares. Moreover, Renaissance Technologies, Point72 Asset Management, and D E Shaw were also bullish on Consolidated Communications Holdings Inc (NASDAQ:CNSL), allocating a large percentage of their portfolios to this stock.

Since Consolidated Communications Holdings Inc (NASDAQ:CNSL) has experienced declining sentiment from hedge fund managers, it's easy to see that there was a specific group of money managers who sold off their full holdings in the third quarter. It's worth mentioning that John Brennan's Sirios Capital Management dumped the largest stake of all the hedgies monitored by Insider Monkey, totaling an estimated $3.8 million in stock, and Israel Englander's Millennium Management was right behind this move, as the fund cut about $1.3 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds in the third quarter.

Let's go over hedge fund activity in other stocks similar to Consolidated Communications Holdings Inc (NASDAQ:CNSL). These stocks are Triumph Bancorp Inc (NASDAQ:TBK), Valhi, Inc. (NYSE:VHI), Century Aluminum Co (NASDAQ:CENX), and Huami Corporation (NYSE:HMI). This group of stocks' market values match CNSL's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TBK,5,56315,-1 VHI,6,5844,-3 CENX,12,36782,1 HMI,4,7550,0 Average,6.75,26623,-0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $13 million in CNSL's case. Century Aluminum Co (NASDAQ:CENX) is the most popular stock in this table. On the other hand Huami Corporation (NYSE:HMI) is the least popular one with only 4 bullish hedge fund positions. Consolidated Communications Holdings Inc (NASDAQ:CNSL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately CNSL wasn't nearly as popular as these 20 stocks and hedge funds that were betting on CNSL were disappointed as the stock returned -55.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index