Here’s What Hedge Funds Think About Darling Ingredients Inc. (DAR)

Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don't publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That's why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Darling Ingredients Inc. (NYSE:DAR) from the perspective of those elite funds.

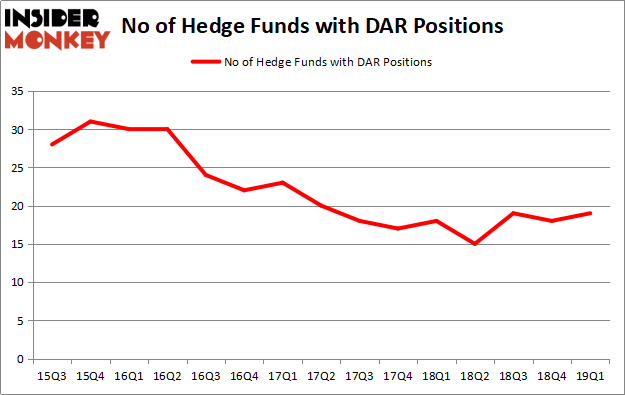

Darling Ingredients Inc. (NYSE:DAR) was in 19 hedge funds' portfolios at the end of the first quarter of 2019. DAR investors should pay attention to an increase in hedge fund sentiment in recent months. There were 18 hedge funds in our database with DAR positions at the end of the previous quarter. Our calculations also showed that DAR isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We're going to take a peek at the key hedge fund action regarding Darling Ingredients Inc. (NYSE:DAR).

What does smart money think about Darling Ingredients Inc. (NYSE:DAR)?

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DAR over the last 15 quarters. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Darling Ingredients Inc. (NYSE:DAR), with a stake worth $47.8 million reported as of the end of March. Trailing Fisher Asset Management was Impax Asset Management, which amassed a stake valued at $42.2 million. ValueAct Capital, Inherent Group, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers were breaking ground themselves. CQS Cayman LP, managed by Michael Hintze, initiated the most outsized position in Darling Ingredients Inc. (NYSE:DAR). CQS Cayman LP had $9.6 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital also made a $1.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Minhua Zhang's Weld Capital Management, Paul Tudor Jones's Tudor Investment Corp, and Ken Griffin's Citadel Investment Group.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Darling Ingredients Inc. (NYSE:DAR) but similarly valued. These stocks are Aaron's, Inc. (NYSE:AAN), Ultragenyx Pharmaceutical Inc (NASDAQ:RARE), NorthWestern Corporation (NYSE:NWE), and Covetrus, Inc. (NASDAQ:CVET). All of these stocks' market caps resemble DAR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position AAN,20,244703,-1 RARE,18,319720,4 NWE,15,188627,0 CVET,18,537367,18 Average,17.75,322604,5.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $323 million. That figure was $210 million in DAR's case. Aaron's, Inc. (NYSE:AAN) is the most popular stock in this table. On the other hand NorthWestern Corporation (NYSE:NWE) is the least popular one with only 15 bullish hedge fund positions. Darling Ingredients Inc. (NYSE:DAR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately DAR wasn't nearly as popular as these 20 stocks and hedge funds that were betting on DAR were disappointed as the stock returned -7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index