Here’s What Hedge Funds Think About Denny’s Corporation (DENN)

Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell's pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Denny's Corporation (NASDAQ:DENN).

Hedge fund interest in Denny's Corporation (NASDAQ:DENN) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren't the only variables you need to analyze to decipher hedge funds' perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That's why at the end of this article we will examine companies such as Orion Engineered Carbons SA (NYSE:OEC), Essential Properties Realty Trust, Inc. (NYSE:EPRT), and Rent-A-Center Inc (NASDAQ:RCII) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let's take a peek at the latest hedge fund action encompassing Denny's Corporation (NASDAQ:DENN).

What have hedge funds been doing with Denny's Corporation (NASDAQ:DENN)?

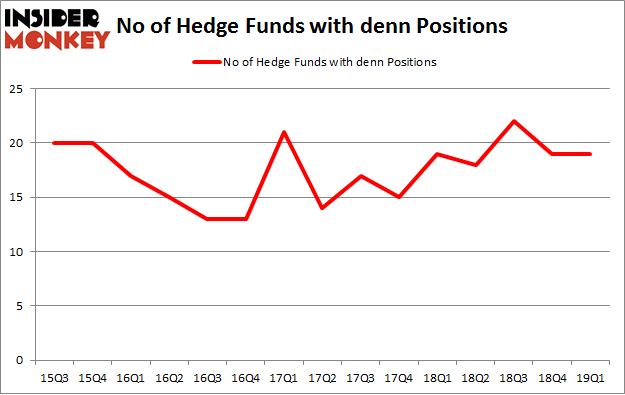

At Q1's end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in DENN a year ago. With hedge funds' positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Denny's Corporation (NASDAQ:DENN), with a stake worth $66.2 million reported as of the end of March. Trailing Renaissance Technologies was Cardinal Capital, which amassed a stake valued at $65.6 million. Arrowstreet Capital, D E Shaw, and GAMCO Investors were also very fond of the stock, giving the stock large weights in their portfolios.

Since Denny's Corporation (NASDAQ:DENN) has experienced falling interest from the entirety of the hedge funds we track, it's easy to see that there were a few money managers that decided to sell off their full holdings heading into Q3. It's worth mentioning that Paul Marshall and Ian Wace's Marshall Wace LLP sold off the largest position of all the hedgies followed by Insider Monkey, comprising about $4.2 million in stock, and Ken Griffin's Citadel Investment Group was right behind this move, as the fund dropped about $1.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let's also examine hedge fund activity in other stocks similar to Denny's Corporation (NASDAQ:DENN). We will take a look at Orion Engineered Carbons SA (NYSE:OEC), Essential Properties Realty Trust, Inc. (NYSE:EPRT), Rent-A-Center Inc (NASDAQ:RCII), and World Acceptance Corp. (NASDAQ:WRLD). All of these stocks' market caps are similar to DENN's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position OEC,23,249517,0 EPRT,13,127309,0 RCII,21,302579,2 WRLD,13,239202,-3 Average,17.5,229652,-0.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $230 million. That figure was $172 million in DENN's case. Orion Engineered Carbons SA (NYSE:OEC) is the most popular stock in this table. On the other hand Essential Properties Realty Trust, Inc. (NYSE:EPRT) is the least popular one with only 13 bullish hedge fund positions. Denny's Corporation (NASDAQ:DENN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on DENN as the stock returned 6.4% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index