Here’s What Hedge Funds Think About FedNat Holding Company (FNHC)

Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is FedNat Holding Company (NASDAQ:FNHC), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

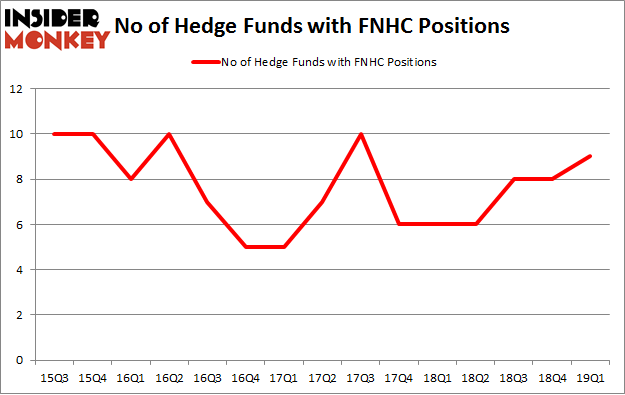

Is FedNat Holding Company (NASDAQ:FNHC) a healthy stock for your portfolio? Money managers are in an optimistic mood. The number of bullish hedge fund bets improved by 1 recently. Our calculations also showed that fnhc isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

[caption id="attachment_30621" align="aligncenter" width="487"]

Cliff Asness of AQR Capital Management[/caption]

We're going to take a look at the recent hedge fund action regarding FedNat Holding Company (NASDAQ:FNHC).

How are hedge funds trading FedNat Holding Company (NASDAQ:FNHC)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards FNHC over the last 15 quarters. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of FedNat Holding Company (NASDAQ:FNHC), with a stake worth $10.2 million reported as of the end of March. Trailing Renaissance Technologies was Capital Returns Management, which amassed a stake valued at $10.1 million. GLG Partners, AQR Capital Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers were breaking ground themselves. Winton Capital Management, managed by David Harding, established the most outsized position in FedNat Holding Company (NASDAQ:FNHC). Winton Capital Management had $0.2 million invested in the company at the end of the quarter. Ken Griffin's Citadel Investment Group also initiated a $0.2 million position during the quarter.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as FedNat Holding Company (NASDAQ:FNHC) but similarly valued. These stocks are Jounce Therapeutics, Inc. (NASDAQ:JNCE), Ardmore Shipping Corp (NYSE:ASC), Lifevantage Corporation (NASDAQ:LFVN), and Foamix Pharmaceuticals Ltd (NASDAQ:FOMX). This group of stocks' market values are closest to FNHC's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position JNCE,10,7393,2 ASC,9,20991,-1 LFVN,11,23500,0 FOMX,15,66772,0 Average,11.25,29664,0.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $30 million in FNHC's case. Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) is the most popular stock in this table. On the other hand Ardmore Shipping Corp (NYSE:ASC) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks FedNat Holding Company (NASDAQ:FNHC) is even less popular than ASC. Hedge funds dodged a bullet by taking a bearish stance towards FNHC. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FNHC wasn't nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); FNHC investors were disappointed as the stock returned -13.4% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index