Here’s What Hedge Funds Think About Gerdau SA (GGB)

While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors kept their optimism regarding the current bull run in the fourth quarter, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Gerdau SA (NYSE:GGB).

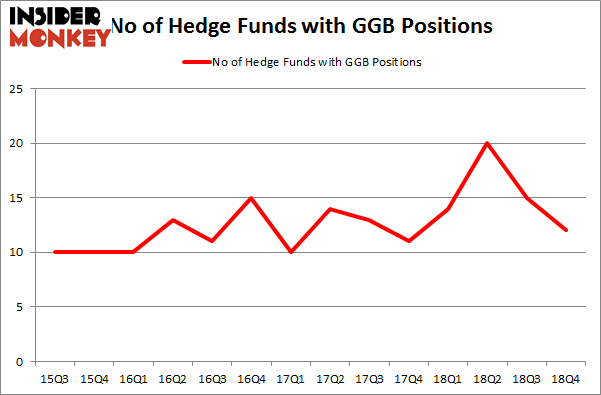

Is Gerdau SA (NYSE:GGB) undervalued? Prominent investors are becoming less hopeful. The number of bullish hedge fund bets dropped by 3 in recent months. Our calculations also showed that GGB isn't among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let's take a look at the new hedge fund action encompassing Gerdau SA (NYSE:GGB).

What does the smart money think about Gerdau SA (NYSE:GGB)?

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from one quarter earlier. By comparison, 14 hedge funds held shares or bullish call options in GGB a year ago. With hedge funds' sentiment swirling, there exists a select group of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jon Bauer's Contrarian Capital has the most valuable position in Gerdau SA (NYSE:GGB), worth close to $60.4 million, comprising 5.6% of its total 13F portfolio. Coming in second is GLG Partners, led by Noam Gottesman, holding a $50.9 million position; 0.2% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism consist of Ken Fisher's Fisher Asset Management, Jim Simons's Renaissance Technologies and David Costen Haley's HBK Investments.

Seeing as Gerdau SA (NYSE:GGB) has experienced declining sentiment from the entirety of the hedge funds we track, logic holds that there were a few funds that decided to sell off their entire stakes last quarter. Interestingly, Ken Heebner's Capital Growth Management dumped the biggest position of the "upper crust" of funds watched by Insider Monkey, totaling an estimated $84.2 million in stock, and Paul Marshall and Ian Wace's Marshall Wace LLP was right behind this move, as the fund cut about $5.1 million worth. These transactions are interesting, as total hedge fund interest fell by 3 funds last quarter.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Gerdau SA (NYSE:GGB) but similarly valued. We will take a look at The Madison Square Garden Company (NASDAQ:MSG), Kilroy Realty Corp (NYSE:KRC), Santander Consumer USA Holdings Inc (NYSE:SC), and East West Bancorp, Inc. (NASDAQ:EWBC). This group of stocks' market caps resemble GGB's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position MSG,46,1733627,6 KRC,13,178217,1 SC,21,565375,-5 EWBC,27,461953,-2 Average,26.75,734793,0 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $735 million. That figure was $143 million in GGB's case. The Madison Square Garden Company (NYSE:MSG) is the most popular stock in this table. On the other hand Kilroy Realty Corp (NYSE:KRC) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Gerdau SA (NYSE:GGB) is even less popular than KRC. Considering that hedge funds aren't fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn't behind this stock. This isn't necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately GGB wasn't in this group. Hedge funds that bet on GGB were disappointed as the stock returned 10.9% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index