Here’s What Hedge Funds Think About Gritstone Oncology, Inc. (GRTS)

You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

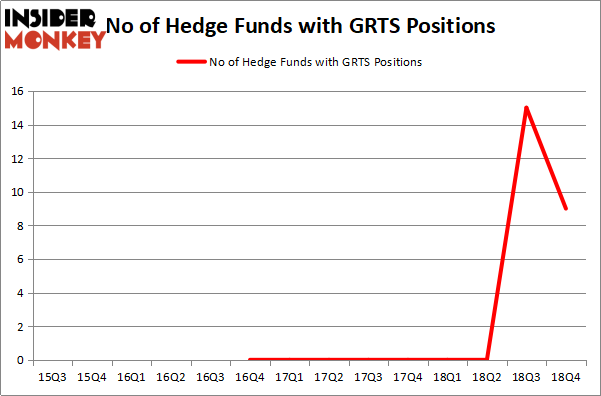

Gritstone Oncology, Inc. (NASDAQ:GRTS) was in 9 hedge funds' portfolios at the end of the fourth quarter of 2018. GRTS investors should be aware of a decrease in hedge fund interest in recent months. There were 15 hedge funds in our database with GRTS holdings at the end of the previous quarter. Our calculations also showed that GRTS isn't among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are perceived as worthless, outdated financial vehicles of years past. While there are more than 8000 funds with their doors open at present, Our researchers look at the top tier of this club, around 750 funds. These investment experts oversee the majority of the hedge fund industry's total capital, and by tracking their highest performing stock picks, Insider Monkey has formulated several investment strategies that have historically outrun the market. Insider Monkey's flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let's review the fresh hedge fund action surrounding Gritstone Oncology, Inc. (NASDAQ:GRTS).

What have hedge funds been doing with Gritstone Oncology, Inc. (NASDAQ:GRTS)?

At Q4's end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -40% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GRTS over the last 14 quarters. With hedgies' positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Redmile Group held the most valuable stake in Gritstone Oncology, Inc. (NASDAQ:GRTS), which was worth $35.1 million at the end of the fourth quarter. On the second spot was Frazier Healthcare Partners which amassed $31.9 million worth of shares. Moreover, Partner Fund Management, Casdin Capital, and Wildcat Capital Management were also bullish on Gritstone Oncology, Inc. (NASDAQ:GRTS), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Gritstone Oncology, Inc. (NASDAQ:GRTS) has experienced falling interest from the aggregate hedge fund industry, we can see that there is a sect of funds that slashed their entire stakes in the third quarter. It's worth mentioning that Zach Schreiber's Point State Capital said goodbye to the largest investment of the "upper crust" of funds tracked by Insider Monkey, comprising close to $1.9 million in stock. Anand Parekh's fund, Alyeska Investment Group, also sold off its stock, about $1.6 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 6 funds in the third quarter.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Gritstone Oncology, Inc. (NASDAQ:GRTS) but similarly valued. We will take a look at Covia Holdings Corporation (NYSE:CVIA), The First Bancshares, Inc. (MS) (NASDAQ:FBMS), Access National Corporation (NASDAQ:ANCX), and CAI International Inc (NYSE:CAI). This group of stocks' market valuations are closest to GRTS's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CVIA,5,44983,-2 FBMS,5,28942,-2 ANCX,2,11005,-1 CAI,17,102799,2 Average,7.25,46932,-0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $97 million in GRTS's case. CAI International Inc (NYSE:CAI) is the most popular stock in this table. On the other hand Access National Corporation (NASDAQ:ANCX) is the least popular one with only 2 bullish hedge fund positions. Gritstone Oncology, Inc. (NASDAQ:GRTS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately GRTS wasn't nearly as popular as these 15 stock and hedge funds that were betting on GRTS were disappointed as the stock returned -5.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index