Here’s What Hedge Funds Think About HFF, Inc. (HF)

Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That's why we pay special attention to hedge fund activity in these stocks.

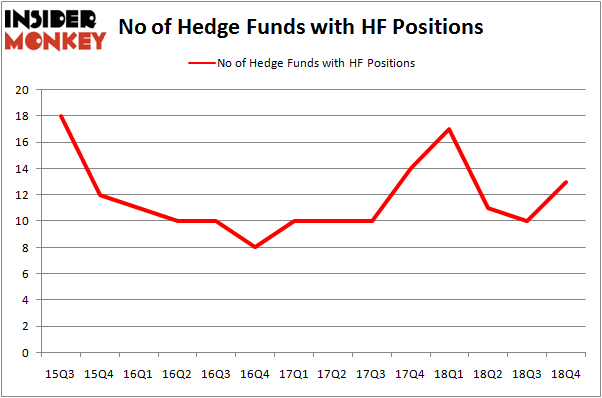

HFF, Inc. (NYSE:HF) investors should pay attention to an increase in support from the world's most elite money managers in recent months. HF was in 13 hedge funds' portfolios at the end of the fourth quarter of 2018. There were 10 hedge funds in our database with HF holdings at the end of the previous quarter. Our calculations also showed that HF isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let's take a peek at the latest hedge fund action surrounding HFF, Inc. (NYSE:HF).

Hedge fund activity in HFF, Inc. (NYSE:HF)

At Q4's end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards HF over the last 14 quarters. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in HFF, Inc. (NYSE:HF), which was worth $4.9 million at the end of the fourth quarter. On the second spot was GLG Partners which amassed $3.5 million worth of shares. Moreover, Prescott Group Capital Management, Renaissance Technologies, and Arrowstreet Capital were also bullish on HFF, Inc. (NYSE:HF), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds were breaking ground themselves. Renaissance Technologies, managed by Jim Simons, established the most valuable position in HFF, Inc. (NYSE:HF). Renaissance Technologies had $1.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace's Marshall Wace LLP also made a $1.2 million investment in the stock during the quarter. The other funds with brand new HF positions are Israel Englander's Millennium Management, Ken Griffin's Citadel Investment Group, and Michael Platt and William Reeves's BlueCrest Capital Mgmt..

Let's now review hedge fund activity in other stocks - not necessarily in the same industry as HFF, Inc. (NYSE:HF) but similarly valued. We will take a look at SPX FLOW, Inc. (NYSE:FLOW), GTT Communications Inc (NYSE:GTT), NutriSystem Inc. (NASDAQ:NTRI), and Redfin Corporation (NASDAQ:RDFN). This group of stocks' market caps are similar to HF's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position FLOW,20,131015,7 GTT,15,350150,1 NTRI,29,273976,11 RDFN,7,114016,-5 Average,17.75,217289,3.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $217 million. That figure was $16 million in HF's case. NutriSystem Inc. (NASDAQ:NTRI) is the most popular stock in this table. On the other hand Redfin Corporation (NASDAQ:RDFN) is the least popular one with only 7 bullish hedge fund positions. HFF, Inc. (NYSE:HF) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on HF as the stock returned 49.9% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index