Here’s What Hedge Funds Think About At Home Group Inc. (HOME)

At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we've gathered as a result gives us access to a wealth of collective knowledge based on these firms' portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not At Home Group Inc. (NYSE:HOME) makes for a good investment right now.

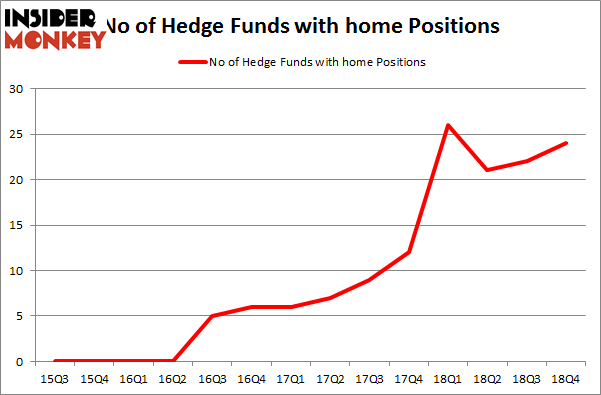

Is At Home Group Inc. (NYSE:HOME) going to take off soon? Prominent investors are in a bullish mood. The number of long hedge fund positions advanced by 2 recently. Our calculations also showed that home isn't among the 30 most popular stocks among hedge funds. HOME was in 24 hedge funds' portfolios at the end of the fourth quarter of 2018. There were 22 hedge funds in our database with HOME holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let's view the new hedge fund action surrounding At Home Group Inc. (NYSE:HOME).

Hedge fund activity in At Home Group Inc. (NYSE:HOME)

At the end of the fourth quarter, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards HOME over the last 14 quarters. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Balyasny Asset Management, managed by Dmitry Balyasny, holds the most valuable position in At Home Group Inc. (NYSE:HOME). Balyasny Asset Management has a $24.2 million position in the stock, comprising 0.2% of its 13F portfolio. On Balyasny Asset Management's heels is Owl Creek Asset Management, led by Jeffrey Altman, holding a $23.8 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Remaining peers that are bullish comprise Israel Englander's Millennium Management, Andrew Bellas's General Equity Partners and John Lykouretzos's Hoplite Capital Management.

Consequently, some big names were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, created the most valuable position in At Home Group Inc. (NYSE:HOME). Balyasny Asset Management had $24.2 million invested in the company at the end of the quarter. Jeffrey Altman's Owl Creek Asset Management also made a $23.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Andrew Bellas's General Equity Partners, John Lykouretzos's Hoplite Capital Management, and Gregg J. Powers's Private Capital Management.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as At Home Group Inc. (NYSE:HOME) but similarly valued. We will take a look at NeoGenomics, Inc. (NASDAQ:NEO), Cavco Industries, Inc. (NASDAQ:CVCO), NMI Holdings Inc (NASDAQ:NMIH), and TPG Specialty Lending Inc (NYSE:TSLX). All of these stocks' market caps are closest to HOME's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NEO,24,116168,7 CVCO,22,143203,3 NMIH,16,165096,4 TSLX,10,39083,0 Average,18,115888,3.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $116 million. That figure was $218 million in HOME's case. NeoGenomics, Inc. (NASDAQ:NEO) is the most popular stock in this table. On the other hand TPG Specialty Lending Inc (NYSE:TSLX) is the least popular one with only 10 bullish hedge fund positions. At Home Group Inc. (NYSE:HOME) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on HOME, though not to the same extent, as the stock returned 17.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index