Here is What Hedge Funds Think About Invesco Ltd. (IVZ)

It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 7% during October and average hedge fund losing about 3%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by about 4 percentage points during the first half of Q4, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Invesco Ltd. (NYSE:IVZ) during the quarter below.

Is Invesco Ltd. (NYSE:IVZ) a great investment today? The smart money is in a bullish mood. The number of long hedge fund positions increased by 8 recently. Our calculations also showed that ivz isn't among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are viewed as slow, outdated financial vehicles of years past. While there are more than 8,000 funds trading today, Our researchers hone in on the moguls of this group, approximately 700 funds. These investment experts administer the majority of the hedge fund industry's total asset base, and by observing their finest picks, Insider Monkey has formulated several investment strategies that have historically outpaced the S&P 500 index. Insider Monkey's flagship hedge fund strategy beat the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We're going to check out the new hedge fund action regarding Invesco Ltd. (NYSE:IVZ).

How are hedge funds trading Invesco Ltd. (NYSE:IVZ)?

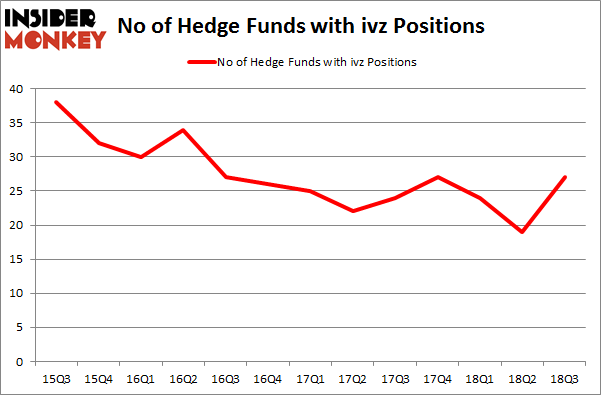

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 42% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards IVZ over the last 13 quarters. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Invesco Ltd. (NYSE:IVZ) was held by Pzena Investment Management, which reported holding $84.5 million worth of stock at the end of September. It was followed by AQR Capital Management with a $36.3 million position. Other investors bullish on the company included Renaissance Technologies, Select Equity Group, and Bridgewater Associates.

Now, key hedge funds were leading the bulls' herd. Select Equity Group, managed by Robert Joseph Caruso, initiated the most outsized position in Invesco Ltd. (NYSE:IVZ). Select Equity Group had $29.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace's Marshall Wace LLP also made a $2.1 million investment in the stock during the quarter. The following funds were also among the new IVZ investors: Charles Lemonides's Valueworks LLC, George Soros's Soros Fund Management, and Ben Levine, Andrew Manuel and Stefan Renold's LMR Partners.

Let's check out hedge fund activity in other stocks similar to Invesco Ltd. (NYSE:IVZ). These stocks are Huazhu Group Limited (NASDAQ:HTHT), Amdocs Limited (NYSE:DOX), Bio-Rad Laboratories, Inc. (NYSE:BIO), and Everest Re Group Ltd (NYSE:RE). This group of stocks' market caps are similar to IVZ's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position HTHT,14,41162,-1 DOX,21,643420,0 BIO,38,811052,2 RE,14,486625,-6 Average,21.75,495565,-1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $496 million. That figure was $284 million in IVZ's case. Bio-Rad Laboratories, Inc. (NYSE:BIO) is the most popular stock in this table. On the other hand China Lodging Group, Limited (NASDAQ:HTHT) is the least popular one with only 14 bullish hedge fund positions. Invesco Ltd. (NYSE:IVZ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard BIO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index