Here’s What Hedge Funds Think About Murphy Oil Corporation (MUR)

With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was Murphy Oil Corporation (NYSE:MUR).

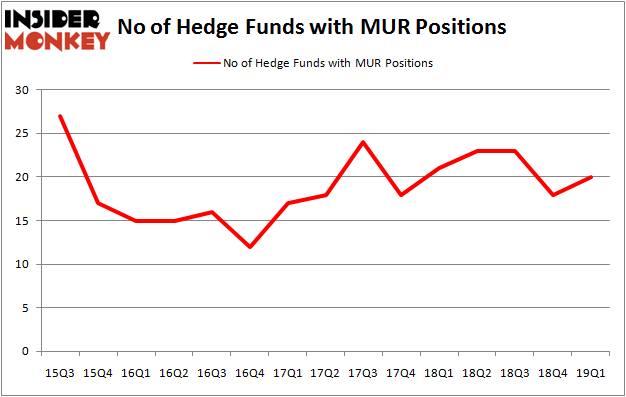

Murphy Oil Corporation (NYSE:MUR) investors should be aware of an increase in activity from the world's largest hedge funds lately. MUR was in 20 hedge funds' portfolios at the end of the first quarter of 2019. There were 18 hedge funds in our database with MUR positions at the end of the previous quarter. Our calculations also showed that MUR isn't among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to analyze the fresh hedge fund action encompassing Murphy Oil Corporation (NYSE:MUR).

What does the smart money think about Murphy Oil Corporation (NYSE:MUR)?

At Q1's end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the fourth quarter of 2018. On the other hand, there were a total of 21 hedge funds with a bullish position in MUR a year ago. With hedge funds' capital changing hands, there exists a few key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the most valuable position in Murphy Oil Corporation (NYSE:MUR). D E Shaw has a $49 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Richard S. Pzena of Pzena Investment Management, with a $45.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other peers with similar optimism encompass Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital, Ken Griffin's Citadel Investment Group and Vince Maddi and Shawn Brennan's SIR Capital Management.

Now, key hedge funds were breaking ground themselves. SIR Capital Management, managed by Vince Maddi and Shawn Brennan, established the most outsized position in Murphy Oil Corporation (NYSE:MUR). SIR Capital Management had $23.1 million invested in the company at the end of the quarter. Anand Parekh's Alyeska Investment Group also made a $21.6 million investment in the stock during the quarter. The following funds were also among the new MUR investors: Dmitry Balyasny's Balyasny Asset Management, Brandon Haley's Holocene Advisors, and David Rosen's Rubric Capital Management.

Let's now take a look at hedge fund activity in other stocks similar to Murphy Oil Corporation (NYSE:MUR). These stocks are MDU Resources Group Inc (NYSE:MDU), JBG SMITH Properties (NYSE:JBGS), ITT Inc. (NYSE:ITT), and Crane Co. (NYSE:CR). This group of stocks' market caps match MUR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position MDU,18,189257,-6 JBGS,17,312625,-3 ITT,22,395262,-3 CR,22,334024,-1 Average,19.75,307792,-3.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $308 million. That figure was $325 million in MUR's case. ITT Inc. (NYSE:ITT) is the most popular stock in this table. On the other hand JBG SMITH Properties (NYSE:JBGS) is the least popular one with only 17 bullish hedge fund positions. Murphy Oil Corporation (NYSE:MUR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MUR wasn't nearly as popular as these 20 stocks and hedge funds that were betting on MUR were disappointed as the stock returned -14.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index