Here is What Hedge Funds Think About ServiceMaster Global Holdings Inc (SERV)

Hedge funds are known to underperform the bull markets but that's not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds' consensus picks on average deliver market beating returns. For example in the first 2.5 months of this year the Standard and Poor’s 500 Index returned approximately 13.1% (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only 5% due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns (5%) versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds' purchases. We know better. That's why we scrutinize hedge fund sentiment before we invest in a stock like ServiceMaster Global Holdings Inc (NYSE:SERV).

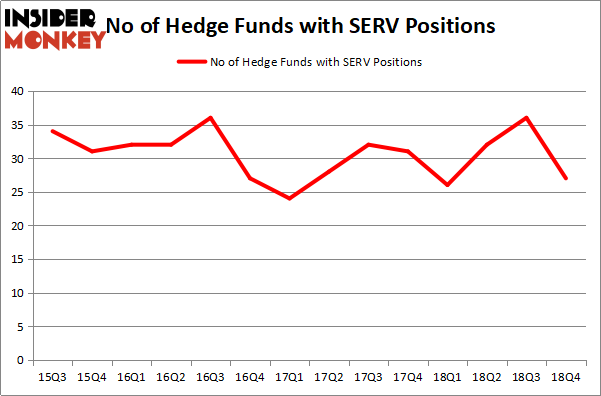

Is ServiceMaster Global Holdings Inc (NYSE:SERV) a safe investment today? Prominent investors are reducing their bets on the stock. The number of bullish hedge fund bets shrunk by 9 lately. Our calculations also showed that SERV isn't among the 30 most popular stocks among hedge funds. SERV was in 27 hedge funds' portfolios at the end of December. There were 36 hedge funds in our database with SERV positions at the end of the previous quarter.

To the average investor there are numerous metrics shareholders put to use to value publicly traded companies. Some of the less utilized metrics are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the best investment managers can outpace their index-focused peers by a significant margin (see the details here).

We're going to go over the latest hedge fund action regarding ServiceMaster Global Holdings Inc (NYSE:SERV).

How are hedge funds trading ServiceMaster Global Holdings Inc (NYSE:SERV)?

At the end of the fourth quarter, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -25% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in SERV a year ago. With hedgies' capital changing hands, there exists an "upper tier" of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Iridian Asset Management, managed by David Cohen and Harold Levy, holds the largest position in ServiceMaster Global Holdings Inc (NYSE:SERV). Iridian Asset Management has a $143.7 million position in the stock, comprising 1.9% of its 13F portfolio. On Iridian Asset Management's heels is Robert Joseph Caruso of Select Equity Group, with a $99 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions contain Jeffrey Gates's Gates Capital Management, Cliff Asness's AQR Capital Management and Israel Englander's Millennium Management.

Judging by the fact that ServiceMaster Global Holdings Inc (NYSE:SERV) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there was a specific group of hedge funds that slashed their positions entirely by the end of the third quarter. Interestingly, Isaac Corre's Governors Lane cut the biggest investment of all the hedgies tracked by Insider Monkey, valued at an estimated $71.1 million in stock. William von Mueffling's fund, Cantillon Capital Management, also dumped its stock, about $69.5 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 9 funds by the end of the third quarter.

Let's now take a look at hedge fund activity in other stocks similar to ServiceMaster Global Holdings Inc (NYSE:SERV). These stocks are Carvana Co. (NYSE:CVNA), Flowserve Corporation (NYSE:FLS), Galapagos NV (NASDAQ:GLPG), and Alcoa Corporation (NYSE:AA). This group of stocks' market values resemble SERV's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CVNA,34,790686,1 FLS,16,178905,3 GLPG,15,92765,-1 AA,30,402782,-8 Average,23.75,366285,-1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $366 million. That figure was $465 million in SERV's case. Carvana Co. (NYSE:CVNA) is the most popular stock in this table. On the other hand Galapagos NV (NASDAQ:GLPG) is the least popular one with only 15 bullish hedge fund positions. ServiceMaster Global Holdings Inc (NYSE:SERV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on SERV as the stock returned 33.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index