Here’s What Hedge Funds Think About Stagnant On PetIQ, Inc. (PETQ)

Is PetIQ, Inc. (NASDAQ:PETQ) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

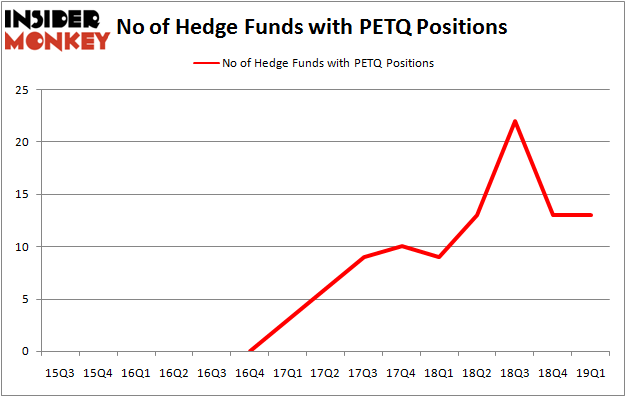

PetIQ, Inc. (NASDAQ:PETQ) shares haven't seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds' portfolios at the end of March. At the end of this article we will also compare PETQ to other stocks including Par Pacific Holdings, Inc. (NYSE:PARR), Mercer International Inc. (NASDAQ:MERC), and Solar Capital Ltd. (NASDAQ:SLRC) to get a better sense of its popularity.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We're going to view the new hedge fund action encompassing PetIQ, Inc. (NASDAQ:PETQ).

How have hedgies been trading PetIQ, Inc. (NASDAQ:PETQ)?

At Q1's end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in PETQ a year ago. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the biggest position in PetIQ, Inc. (NASDAQ:PETQ). D E Shaw has a $20.9 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Buckingham Capital Management, led by David Keidan, holding a $14.9 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions contain Jay Genzer's Thames Capital Management, George McCabe's Portolan Capital Management and Richard Driehaus's Driehaus Capital.

Because PetIQ, Inc. (NASDAQ:PETQ) has experienced falling interest from hedge fund managers, logic holds that there lies a certain "tier" of funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Mark N. Diker's Diker Management dumped the largest position of all the hedgies monitored by Insider Monkey, totaling about $1.2 million in stock. Joseph A. Jolson's fund, Harvest Capital Strategies, also said goodbye to its stock, about $0.9 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let's now review hedge fund activity in other stocks - not necessarily in the same industry as PetIQ, Inc. (NASDAQ:PETQ) but similarly valued. We will take a look at Par Pacific Holdings, Inc. (NYSE:PARR), Mercer International Inc. (NASDAQ:MERC), Solar Capital Ltd. (NASDAQ:SLRC), and Social Capital Hedosophia Holdings Corp. (NYSE:IPOA). This group of stocks' market values are similar to PETQ's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position PARR,16,109870,0 MERC,14,141114,-2 SLRC,11,60312,-1 IPOA,22,283400,1 Average,15.75,148674,-0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $149 million. That figure was $86 million in PETQ's case. Social Capital Hedosophia Holdings Corp. (NYSE:IPOA) is the most popular stock in this table. On the other hand Solar Capital Ltd. (NASDAQ:SLRC) is the least popular one with only 11 bullish hedge fund positions. PetIQ, Inc. (NASDAQ:PETQ) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on PETQ, though not to the same extent, as the stock returned 4.6% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index