Here’s What Hedge Funds Think About Turquoise Hill Resources Ltd (TRQ)

Is Turquoise Hill Resources Ltd (NYSE:TRQ) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It's not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

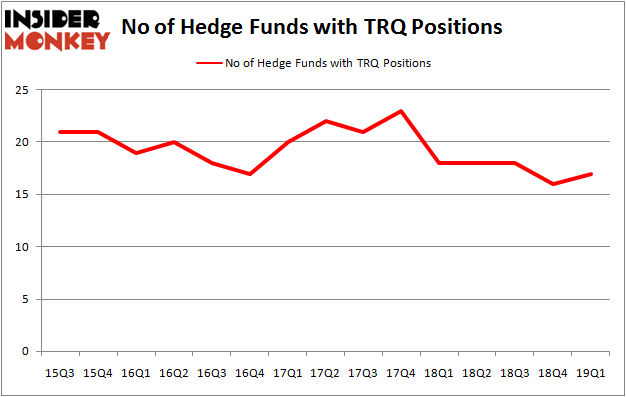

Is Turquoise Hill Resources Ltd (NYSE:TRQ) ready to rally soon? Prominent investors are in a bullish mood. The number of bullish hedge fund positions improved by 1 lately. Our calculations also showed that TRQ isn't among the 30 most popular stocks among hedge funds.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

[caption id="attachment_746825" align="aligncenter" width="473"]

Matthew Halbower -Pentwater Capital[/caption]

We're going to take a gander at the fresh hedge fund action surrounding Turquoise Hill Resources Ltd (NYSE:TRQ).

What does smart money think about Turquoise Hill Resources Ltd (NYSE:TRQ)?

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in TRQ a year ago. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, SailingStone Capital Partners, managed by MacKenzie B. Davis and Kenneth L. Settles Jr, holds the largest position in Turquoise Hill Resources Ltd (NYSE:TRQ). SailingStone Capital Partners has a $398.7 million position in the stock, comprising 26.3% of its 13F portfolio. The second most bullish fund manager is Matthew Halbower of Pentwater Capital Management, with a $311.9 million position; the fund has 3.9% of its 13F portfolio invested in the stock. Remaining peers with similar optimism include David Iben's Kopernik Global Investors, Ken Heebner's Capital Growth Management and Jonathan Barrett and Paul Segal's Luminus Management.

As aggregate interest increased, some big names were breaking ground themselves. Capital Growth Management, managed by Ken Heebner, assembled the most outsized position in Turquoise Hill Resources Ltd (NYSE:TRQ). Capital Growth Management had $36.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace's Marshall Wace LLP also made a $6.8 million investment in the stock during the quarter. The only other fund with a new position in the stock is Michael Platt and William Reeves's BlueCrest Capital Mgmt..

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Turquoise Hill Resources Ltd (NYSE:TRQ) but similarly valued. These stocks are Lions Gate Entertainment Corporation (NYSE:LGF-B), Intercept Pharmaceuticals Inc (NASDAQ:ICPT), The Timken Company (NYSE:TKR), and Paramount Group Inc (NYSE:PGRE). This group of stocks' market valuations resemble TRQ's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position LGF-B,16,285528,-3 ICPT,21,385810,0 TKR,26,288105,1 PGRE,16,236374,2 Average,19.75,298954,0 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $299 million. That figure was $929 million in TRQ's case. The Timken Company (NYSE:TKR) is the most popular stock in this table. On the other hand Lions Gate Entertainment Corporation (NYSE:LGF-B) is the least popular one with only 16 bullish hedge fund positions. Turquoise Hill Resources Ltd (NYSE:TRQ) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately TRQ wasn't nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); TRQ investors were disappointed as the stock returned -27.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index