Helios (HLIO) to Buy NEM, To Boost Electro-Hydraulics Offerings

Helios Technologies, Inc. HLIO yesterday announced that it signed an agreement to acquire Italy-based NEM S.r.l. The financial terms of the definitive deal have been kept under wraps.

NEM specializes in providing hydraulic solutions to be used for construction, material handling, agriculture and industrial vehicle purposes. It has a solid customer base in various regions, especially Asia and Europe.

Inside the Headlines

As noted, the above-mentioned buyout is anticipated to solidify Helios’ offerings in the electro-hydraulics market as well as expand its manufacturing capabilities, geographical reach (especially in Europe) and presence in the OEM market. Also, the buyout will complement Helios’ Cartridge Valve Technology (“CVT”) offerings, especially for customers in agriculture machinery, material handling, industrial and construction markets.

Notably, the assets to be acquired will be integrated with Helios’ Hydraulics segment. The segment offers quick-release hydraulic coupling solutions, cartridge valve technology products and hydraulic system design solutions. Brands offered by the segment are Custom Fluidpower, Sun Hydraulics and Faster.

The segment’s sales expanded 15% year over year to $119.1 million in the first quarter of 2021, driven by solid demand in agriculture and construction markets of the Asia Pacific and Europe, Middle East, Africa (“EMEA”) regions. However, weakness in the American business was spoilsport. It represented 58.2% of the company’s first-quarter revenues.

Subject to the satisfaction of closing conditions, the buyout is anticipated to close in the third quarter of 2021.

Helios’ Buyout Activities

Acquiring businesses are effective ways for the company to gain access to new markets, expand its product line and enhance the customer base. In first-quarter 2021, it invested $1 million on business acquisitions (net of cash acquired).

In May 2021, the company signed an agreement with China-based Shenzhen Joyonway Electronics & Technology Co., Ltd. to acquire the latter’s electronic control systems and parts business. The financial terms of the definitive deal have been kept under wraps. The acquired business, to be integrated with the Electronics segment, is anticipated to solidify Helios’ offerings in the electronic controls platform.

In January, Helios acquired assets of the engineering solution provider, BJN Technologies, LLC. The latter is based in San Antonio, TX. The assets were integrated with Helios’ Electronics segment.

Zacks Rank, Price Performance and Estimate Trend

With a $2.3-billion market capitalization, Helios currently carries a Zacks Rank #2 (Buy). The company is benefiting from its diversification strategy, healthy demand, buyout activities and focus on capacity expansion.

In the past three months, the company’s shares have decreased 0.3% as compared with the industry’s growth of 5.9%.

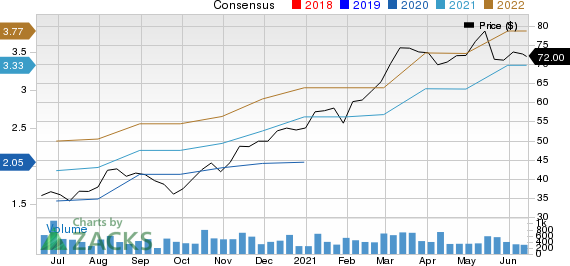

Image Source: Zacks Investment Research

Meanwhile, the Zacks Consensus Estimate for its earnings is pegged at $3.33 for 2021 and $3.78 for 2022, reflecting growth from the respective 60-day-ago figures of $3.01 and $3.48. Also, second-quarter earnings estimates of 85 cents represent growth of 10.4% from the 60-day-ago figure.

Helios Technologies, Inc Price and Consensus

Helios Technologies, Inc price-consensus-chart | Helios Technologies, Inc Quote

Other Stocks to Consider

Some other top-ranked stocks in the industry are Tennant Company TNC, Applied Industrial Technologies, Inc. AIT and Dover Corporation DOV. While Tennant currently sports a Zacks Rank #1 (Strong Buy), both Applied Industrial and Dover carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies have improved for the current year. Further, positive earnings surprise for the last reported quarter was 82.81% for Tennant, 35.64% for Applied Industrial and 23.13% for Dover.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research